Recently we visited the New York Stock Exchange, and there was a Bitcoin buzz in the air. With Bitcoin futures beginning to trade on the CBOE, there were supporters and nay-sayers. Due to a recent soar in prices of Bitcoin, and other cryptocurrencies, these have become a tempting alternative investment. However Bitcoin is currently unregulated, and highly volatile. There is no FDIC to back this new currency.

So what is a Bitcoin? It is a digital currency that can be used to make peer-to-peer payments without an intermediary or bank. Bitcoins have no central backer and rely on a decentralized network of record keepers that all work the same ledger of transactions. These transactions are called the “block chain”. The idea of the block chain is to record all transactions and share this information with the Bitcoin network without having to rely on one entity to verify or control the currency. Miners are rewarded for validating transactions utilizing an equation and in return are paid in Bitcoins. The honest chain will always beat an attacker’s chain by a process known as Binomial Random Walk. This calculation is similar to the Gambler’s Ruin principal. The Good chain will always prevail, similar to how the House always wins in Vegas.

Bitcoin is only worth what the sum of its buyers are willing to pay for it. As with any asset, if everyone stops holding it, the value plummets.

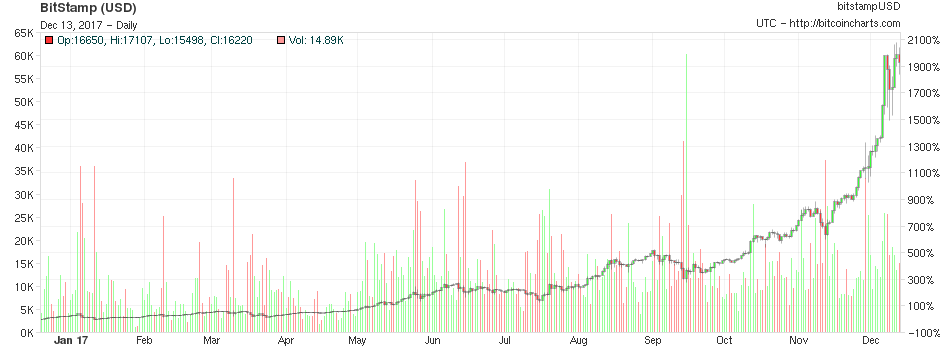

Bitcoin is officially the biggest bubble the world has ever seen as measured as a multiple of its starting price. The spike eclipses the chaos around Dutch “tulip mania” in the 1600s, the Mississippi Bubble of the 1700s, and the dot-com bubble of the late 1990s and early 2000s. Bitcoin has already surged 2000% in the last year alone. But that doesn’t necessary mean the party is over. Blockchain technology has numerous benefits and is here to stay. This technology has the potential to revolutionize transactions by reducing complexity, costs, boosting accuracy and lowering risk.

Will Bitcoin be a homerun, or the biggest loser of this century?

Only time will tell.

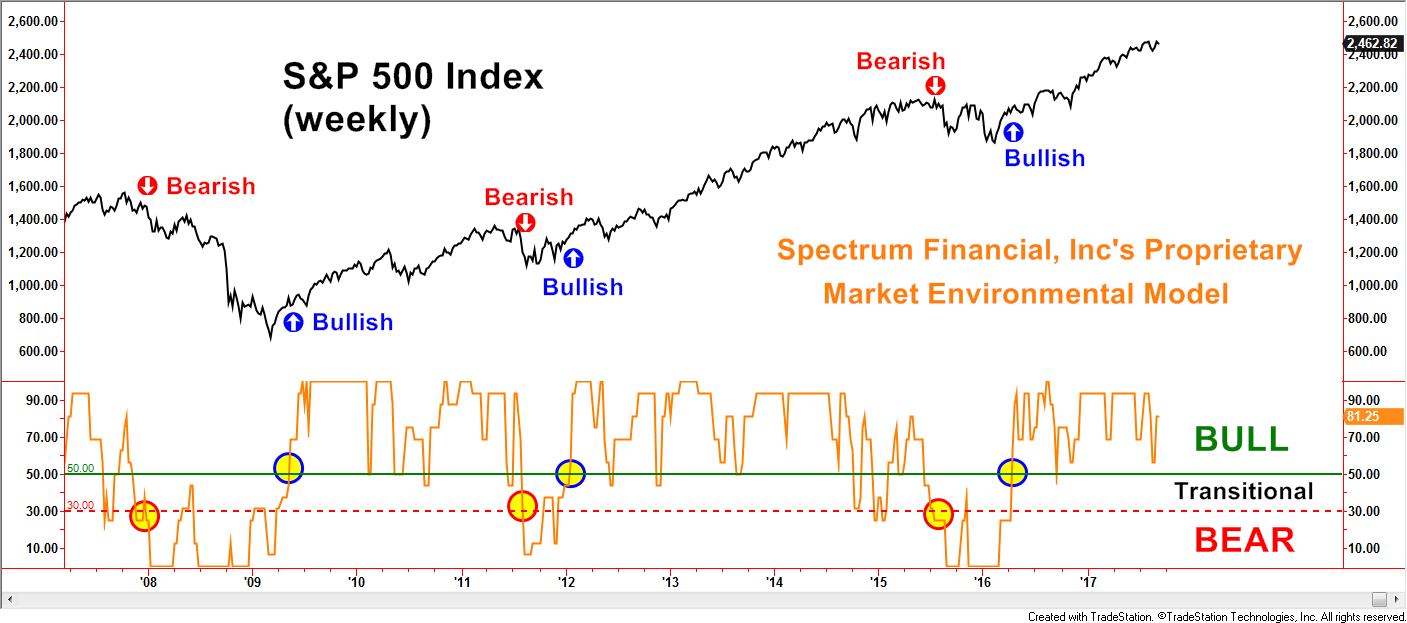

“Steady plodding brings prosperity; hasty speculation brings poverty” (Proverbs 21:5, LB) is written on the back of every newsletter Spectrum has written. We believe in protecting principal so goals like retirement, dream purchases, sending kids or grandkids to college, can be achieved. So, does Bitcoin belong in your Portfolio?