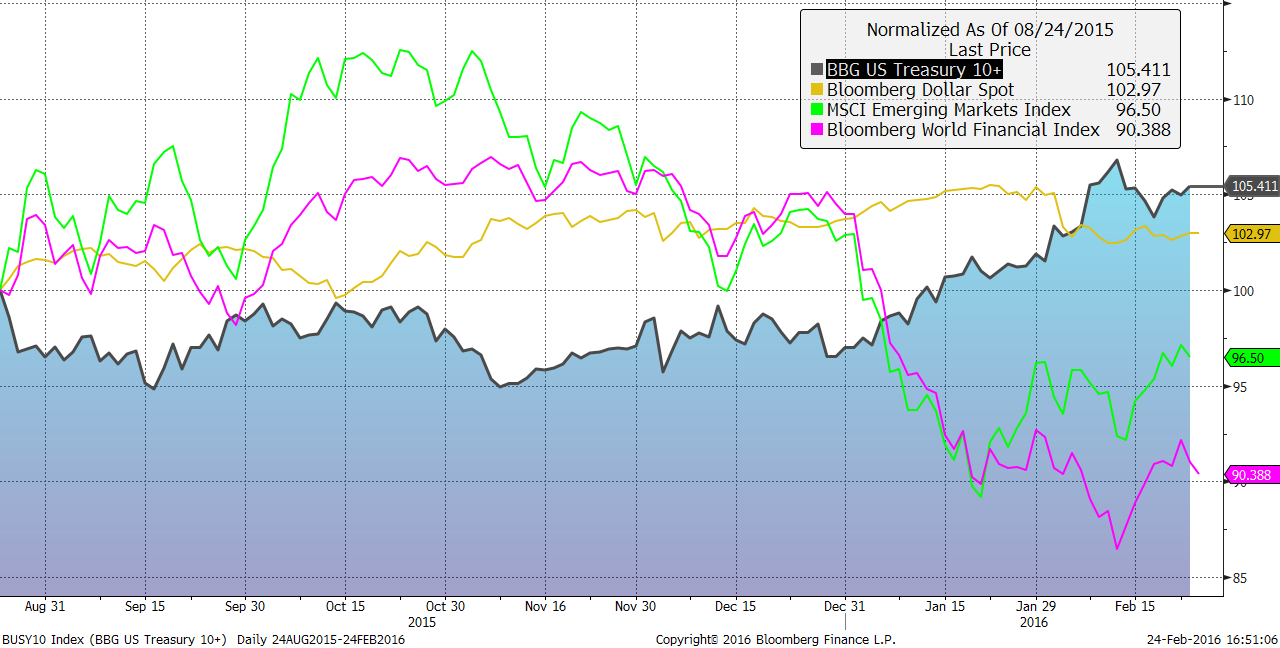

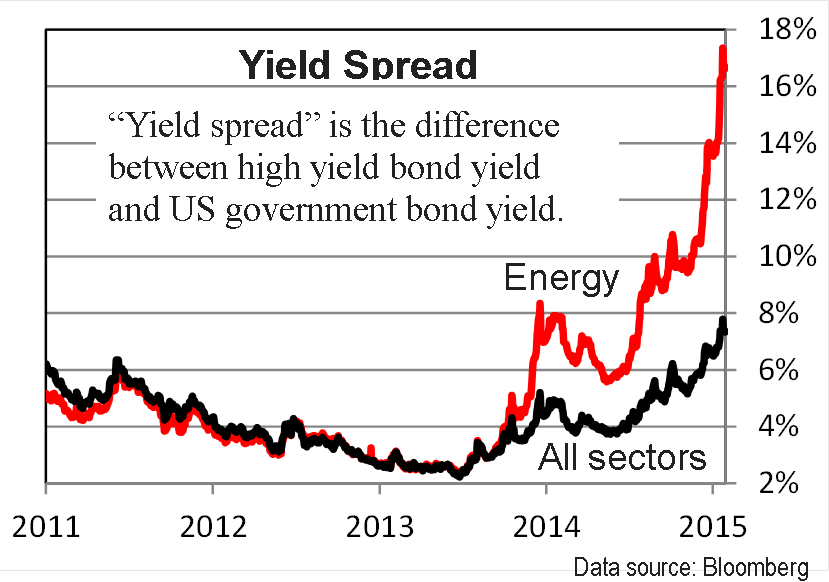

A little more than a year ago, the European Central Bank adopted a negative interest-rate strategy. The Bank of Japan recently followed suit. What is this strategy supposed to achieve, and how is it impacting financial markets? Let’s start by examining what these central banks hope the negative interest-rate strategy achieves. The European Central Bank and the Bank of Japan are now charging their member banks on overnight cash reserves. The idea is to forcibly encourage member banks to loan money to potential customers that may in turn, stimulate the economy through spending, not saving. From the member bank’s perspective, an outcome like that could entail higher than acceptable credit risk on the bank’s loans. Member banks could also pass along the negative interest-rate to depositors which could lead to an exodus of their customers. The decision some banks have chosen is to not charge these negative interest rates to customers which then reduces the member bank’s balance sheets, putting pressure on their profit margins. The weakening of bank balance sheets is being labeled as one of the contributing factors to the stressed financial markets, especially foreign markets (see chart below).

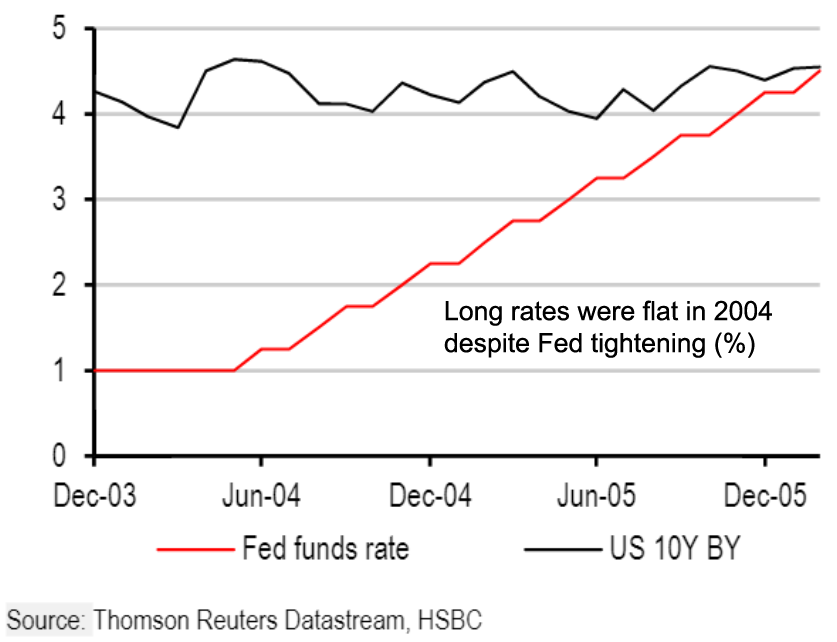

Other choices banks and investors have is to buy government bonds (foreign and US). Investors are taking their foreign assets and depositing them in “safer” US securities, playing a major role in boosting the US Dollar. The US has yet to adopt a negative interest-rate policy but Janet Yellen, the US Federal Reserve chair, has recently gone on record as saying that type of policy is “on the table”. This relatively new financial engineering has rippled through the global financial system and its long-term impact has yet to be seen.

Spectrum’s Portfolio Management Impact:

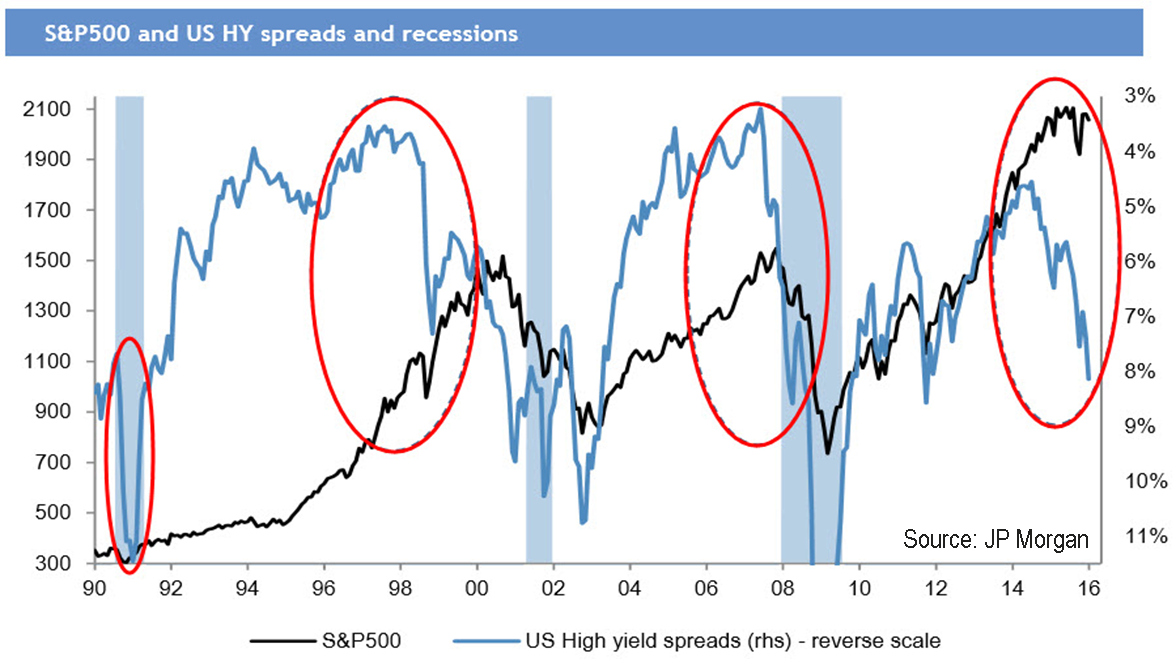

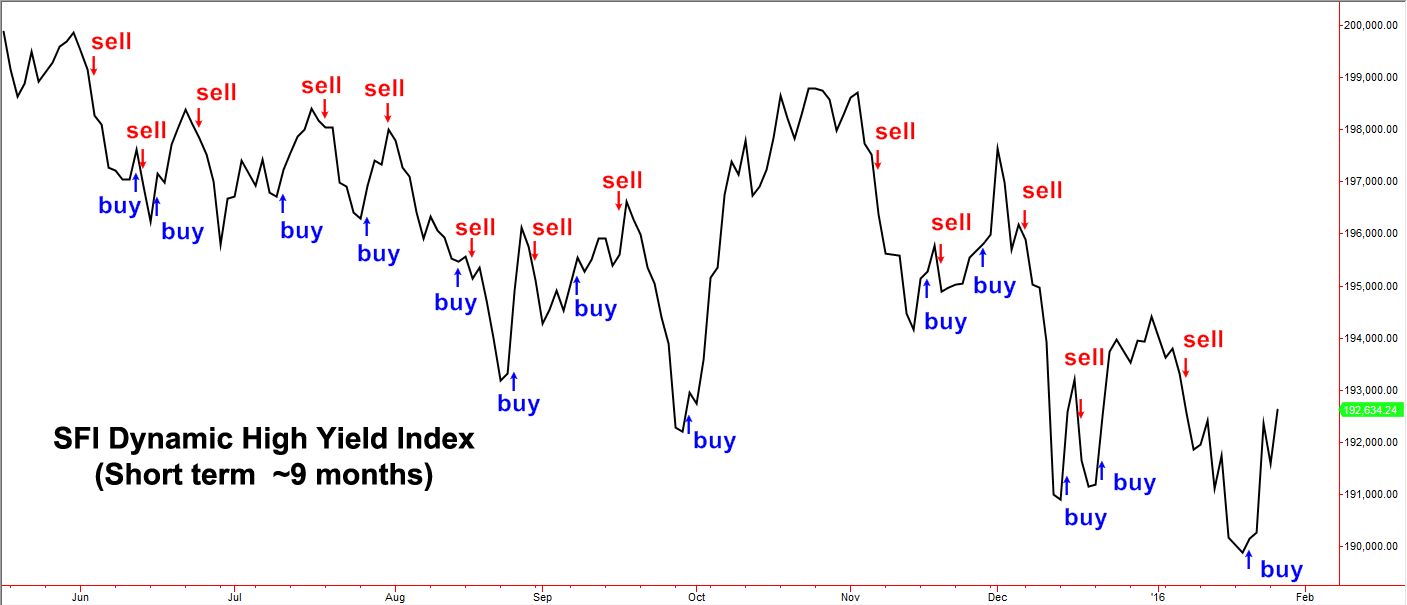

The news itself of negative rates does not specifically cause positions to be altered in the Spectrum’s funds or strategies. The influences, however, to the various asset classes, stocks, bonds, currencies, etc., can be assessed through the price action in those markets. This could be in the form of new trends, up or down, or through jagged price action. More specifically, positive influences can be seen in quality-rated bonds, corporate and government. Upward influences in the US Dollar have played a role in volatility and negative trends seen in global equity markets, primarily the emerging markets. Adjustments within our funds or strategies generally reflect these prevailing trends.

Disclosure

This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Spectrum Financial, Inc. in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Spectrum Financial, Inc. expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. For full disclosure please see disclosures page here.