What is normal?

It seems like the markets are always moving from one crisis to the next and trying to define the “new normal”. Perhaps we can blame the media for promoting drama in attempts to attract viewers. That may occasionally be true but no doubt that legitimate societal stresses are commonplace: wars, high profile corporate or even municipal bankruptcies, terrorist attacks, and natural disasters are just a few reoccurring events or conditions. AND YET…markets have historically rallied back to eventually make new highs.

There are numerous examples on the internet of historical charts showing notable world events and the market’s reaction in price and duration.

TradingView is the source of this chart, originally published 7/4/21 and is one of the more extensive compilations I have seen.

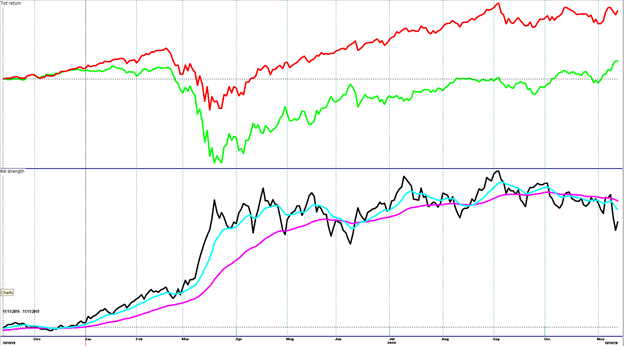

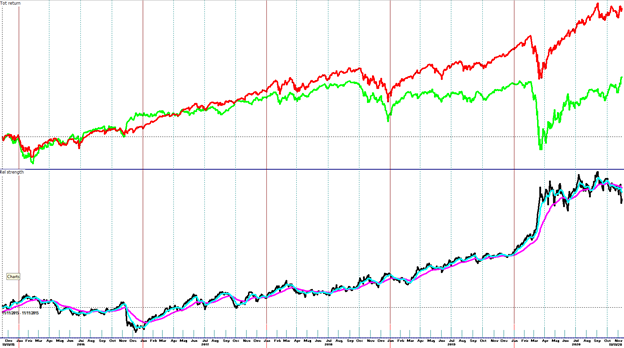

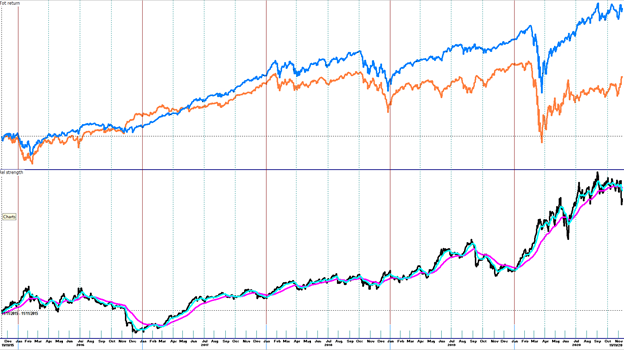

Updating for recent price action (but using the S&P 500 Index), note the significant influences to the recent decline in the chart below.

Created with TradeStation. © TradeStation Technologies, Inc. All rights reserved

The objective or bottom line of most articles, blogs, news stories, charts, etcetera that tie negative news to the stock market tends to be a message that investors should be calm and have hope, with a focus on a brighter future. That advice has been correct for 100% of all pullbacks, corrections and bear markets since stocks began trading under the Buttonwood tree in lower Manhattan, and up through early January of this year. That advice may be oversimplistic as the devil may be in the details.

The Fluidity of Indexes

Historical charts of indexes should be viewed with a grain of salt in that indexes periodically change components and weightings. For example:

- The Dow Jones Industrial Average has removed/added members 57 times since 1896.

- The S&P 500 Index is rebalanced on a quarterly basis.

A committee establishes criteria and companies are added and subtracted. This is a common practice for indexes. Therefore, index charts most often are strung together performances of individual stock constituents held at that time. The all-time highs made in early January by the S&P 500 Index and the Dow Jones Industrial Average were not set by the same stocks within the indexes during the bear market of 2008. Investors that were holders in those particular stocks during the 2008 bear could have been given hope that the indexes should come back eventually. Well – the indexes did but perhaps not with the down and out names held by some investors. Is that idea a pitch for indexing, as in, should investors focus on just owning index investments? No, not necessarily. There is a difference, however, between blind faith in a generalized market recovery in futures versus what companies may participate or be left out.

Let’s shift focus to why.

Again, through January of this year, all negative market periods over the last 100+ years have “recovered”. This view is based on understanding and embracing the foundational economic principle that supports capitalism or at least market driven economies – profit motive. Companies are often started by determined individuals, betting on themselves, looking to enrich their lives which often aligns with the betterment of other lives as well. A lack of product demand and/or a lack of profit will eventually lead to a company’s failure. In the context of this discussion, investors can choose to be a part of a company’s success or failure through stock ownership. There is an individual and corporate drive to succeed in a free market system.

Success is often determined on how a company responds to challenges and crisis. New challenges come with each crisis. New solutions are found and assumed to be rewarded. At the onset of the pandemic, the equity markets fell sharply as questions were brought up regarding how the economy would be affected. Generally speaking, the market then moved higher as answers came to light. Again, some companies have not come back but many have and have done so transformed as evolved versions of themselves.

Now that we have covered topics of optimism, warning, and back to optimism, let’s return to warning.

The duration and depth of crisis have never been consistent. Exhibiting faith in an eventual recovery is one thing, but it should not be blind faith as the pain of the crisis is endured. Active management of investments, adjusting portfolios to changes in risk is not in opposition to the idea of market recovery. The two can be symbiotic.

As investors, we should not be expecting the market to settle into a “new normal”. It will never come if defined as an extended period of a “lack of concerns”. We must accept that “normal” is a constant pursuit of new innovations and ideas and we can participate by way of the markets while dodging and parrying the dangers.

At Spectrum Financial, we continue to pursue risk adjusted opportunities that the market presents and manage life altering risk for our clients.