In an earlier blog post, I asked the question, “Do you use fundamental or technical analysis?” If you recall, it was somewhat a trick question because the topic covered how technical analysis principles could be applied to fundamentals such as economic data. Today, we will circle back around and cover a more traditional comparison of the two disciplines with the purpose of showing how technical analysis is a major input to many actively managed mutual funds.

To borrow a paragraph from the earlier blog; fundamental analysis attempts to uncover the driving forces or reasons for either a current or future investment theme. They may be based on actual results from corporate or economic releases such as sales numbers, employment statistics, new product launches, and countless other data series. Technical analysis attempts to study the results of investor actions, based on the concept that certain actions imply continuation or reversal in direction of the underlying investment or theme. Technical analysis based traders often employ tools such as moving averages, pattern analysis, and volume studies. One could say that “cause and effect” are both assessed when incorporating fundamental and technical analysis.

The two approaches are often seen set against each other. But like the movie Batman v Superman, it is just a matter of perspective and misunderstanding. The two can be friends – even super friends.

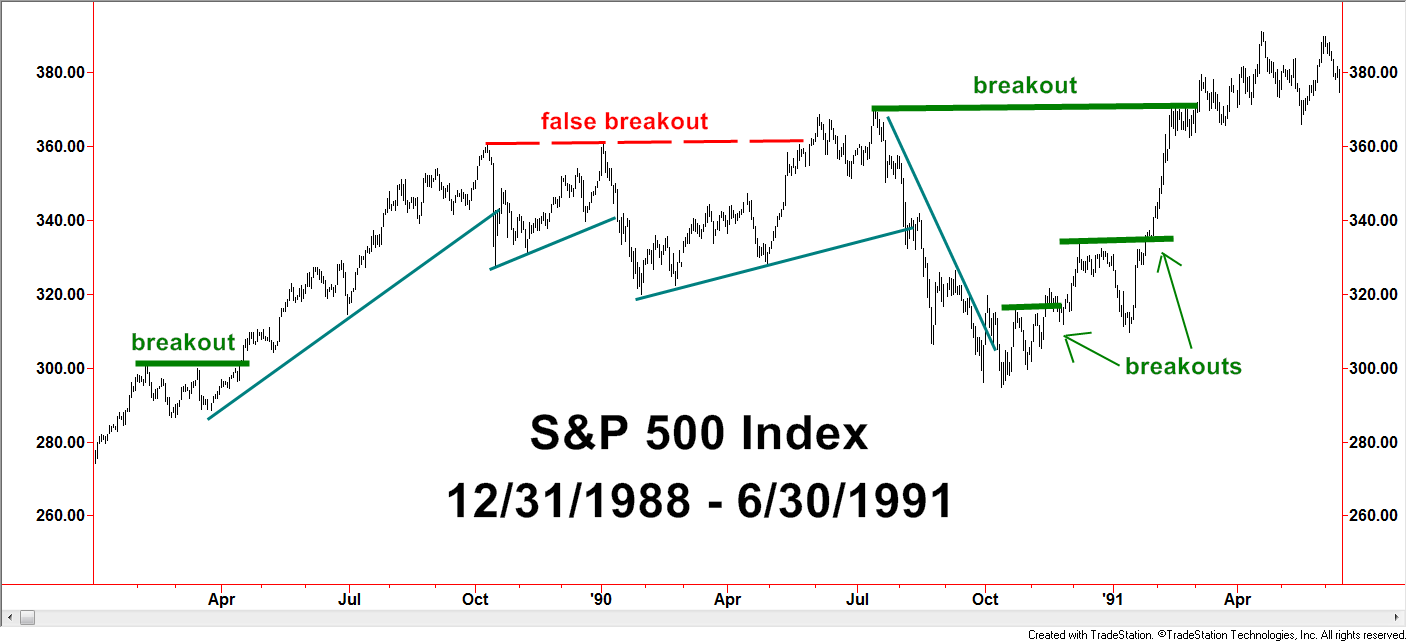

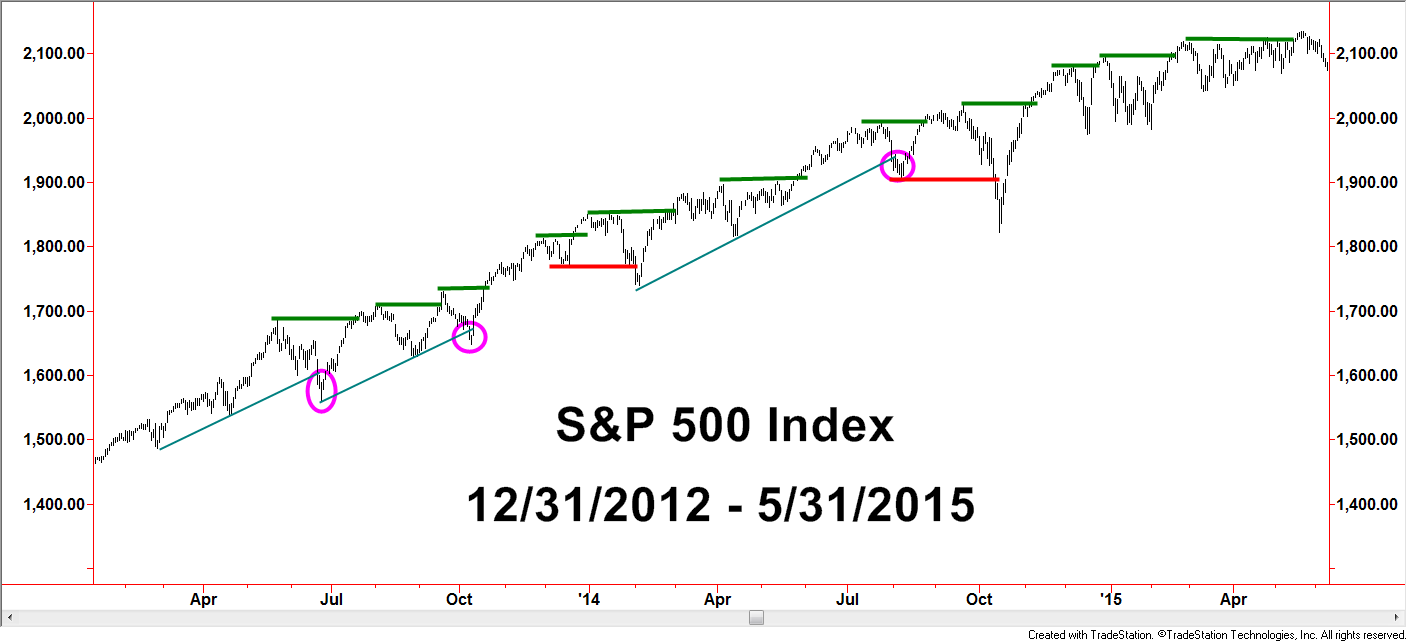

In addition to the differences already noted, let’s contrast other characteristics but do so through the lens of their potential shortcomings. Fundamental analysis seems very rational. It mostly takes facts and figures that are assessed in order to gauge business conditions in the economy, sector, or individual company. How is that a shortcoming? Investment markets can act irrationally. In fact, they tend to do so more often than not and can do so not only for short-periods of time but for extended periods. There is an old Wall Street saying, “the markets can remain irrational for longer than you can remain solvent”. If that statement makes sense to you, then it should be logical to incorporate methods that assess human behavior’s impact to prices which is a key benefit to incorporating technical analysis. Fundamental analysis relies on public information. The shortcomings here are related to garbage in, garbage out as well as the reality that not all relevant information can be known to all those using this discipline. Now let’s be fair, technical analysis also has its share of shortcomings. A common complaint is it does not explain why the bullish or bearish bias exists. If one were to know why, then perhaps greater conviction and position size could be maintained as short-term aberrations away from the “true fundamentals” can be filtered out. That leads to another shortcoming in that technical analysis has a tendency toward a greater number of whipsaws and false conclusions. Notice what we just did – the shortcomings helped to define the two disciplines but the shortcomings were also counter-balanced by the strengths of the other. This sort of synergy is the reason why many investors and portfolio managers incorporate both to some degree even if there is a leaning to one side or the other.

In using technical analysis, we are attempting to measure people’s thinking by looking at their buying and selling actions. Garfield Drew, a well-known trader from early last century once said, “Stocks do not sell for what they are worth, but for what people think they are worth.” Those two ideas sum what technical analysis is all about.

I believe technical analysis is, and should be, the heavier weighting behind investment decisions, especially in regards to active portfolio management

Author and trader, Stan Weinstein once said, “The chart is the ultimate reality”. My interpretation is he means whether or not a movement is justified by the underlying fundamentals, the gain or loss impacts the net worth of the investor. The goal of investing is to increase our net worth, plain and simple. If the fundamentals are generally deemed to be positive but the stock goes down 20%, then what good did that investment do for the investor? We have all witnessed declines of that magnitude or thereabouts without true changes in the underlying fundamentals. “The fundamentals will eventually be recognized and my stock will go back up”. I’ve heard that one too many times to count. Even if that were to be true, can we really absorb such potentially large losses including the opportunity costs while waiting? Technical analysis is not a crystal ball or silver bullet but it can act as a thermometer for investors to gauge the health of the market or individual investments. As we all know, a person may look healthy on the outside while their body holds a sickness yet to display external symptoms.

In coming weeks, we will cover topics that outline tools and techniques that interpret the message of thermometers put in the mouth of the market. “Buy low and sell high” has been a Wall Street creed for decades. Fundamental analysis may be able to identify undervalued and overvalued investments but technical analysis more efficiently identifies trends and potential trend changes that serve as the basis of why active portfolio management funds seek to rotate investments and adjust to rational and irrationally-based risks.

Disclosures

This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Spectrum Financial, Inc. in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Spectrum Financial, Inc. expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. For full disclosure please see disclosures page here.