Most investors at or in retirement need to know how long their portfolios will last when they start withdrawing for income. They know what their monthly living expenses are and how much social security comes in every month. By using an annualized rate of return, retirees can calculate how much money they can withdraw each month from investments to help cover the expenses lacking from social security and any other supplemental source of income they may have.

Younger investors can use annualized returns to help plan their future retirement nest-egg. With an annualized return plugged into the equation, you can easily calculate how much you need to contribute monthly to “have one million dollars when I’m 65.”

“On the first day of every week, each of you is to put something aside and store it up, as he may prosper, so that there will be no collecting when I come.” 1 Corinthians 16:2 English Standard Version

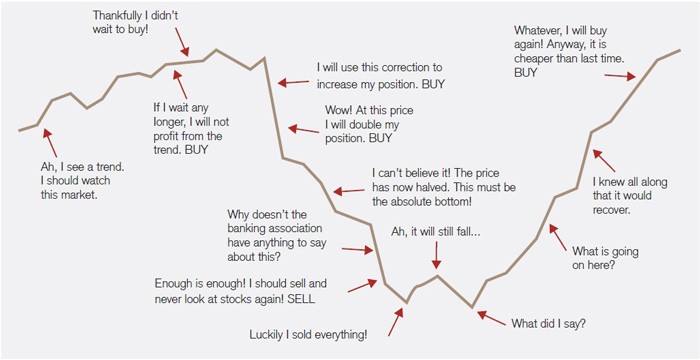

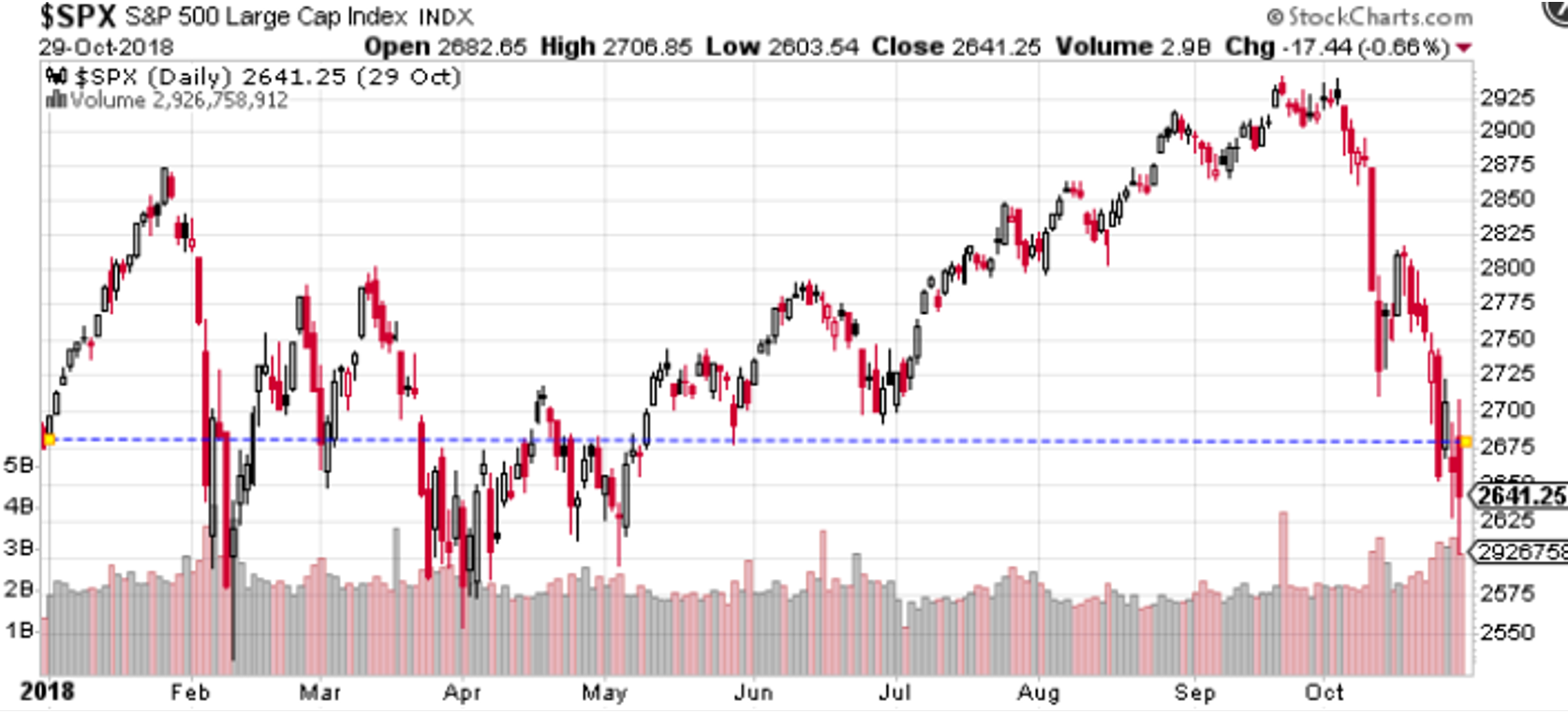

Generally, most sectors of the stock market were down last year. If you owned Advanced Micro Devices, Chipotle, Under Armour or Etsy last year, good for you. Goldman Sachs, IBM, General Electric or Bitcoin? Oops! Many investors saw their portfolios fall 1-15% last year, some even more. That wasn’t in line with the return they were “expecting” based on 5-6% annualized returns the stock market has seen over the last 20 years.

Let’s take a closer look at expectations for earning a 5-6% annualized return on a year-by-year basis. Below are two hypothetical data tables showing the yearly data for calculating the annualized returns shown at the bottom of each table. Table A shows annualized returns for 11 years (2008-2018), table B shows 10 years (2009-2018) of data.

| TABLE A TABLE B | ||||

| Year | Return | Year | Return | |

| 2008 | -17.23% | |||

| 2009 | 31.25% | 2009 | 31.25% | |

| 2010 | 11.21% | 2010 | 11.21% | |

| 2011 | 2.41% | 2011 | 2.41% | |

| 2012 | 14.78% | 2012 | 14.78% | |

| 2013 | 11.10% | 2013 | 11.10% | |

| 2014 | 7.98% | 2014 | 7.98% | |

| 2015 | -2.15% | 2015 | -2.15% | |

| 2016 | 12.11% | 2016 | 12.11% | |

| 2017 | 4.19% | 2017 | 4.19% | |

| 2018 | -2.45% | 2018 | -2.45% | |

| 11 Year Annualized return: | 6.00% | 10 Year Annualized return: | 8.66% | |

The annual returns above are arbitrary, shown to give you an idea how returns have, can and will continue to fluctuate in the future. In Table A, you may notice that there was not one year with a return of 6%. In fact, there were three years of negative returns. Annualized returns are averages that include compounding annual returns over a given period (in this case 10 and 11 years). Investors should expect to see years of returns greater than 6% and years that make less than 6% – and in some years, losses.

Table B shows the same returns, minus 2008 (the last major bear market). By not including the 2008 bear market, the annualized return jumps an additional 2.66%. The lesson here is to make sure you have as much data as possible when looking at historical returns. It is ideal to see returns for a full market cycle (bull and bear market). Looking at returns through a full cycle will do three things: one, prepare you for bear markets, two, give you a better idea of what to expect about long term annualized rates of return when planning for retirement and three, be very realistic on your time horizon.

Back to retirement. Retiree A wants to preserve capital and withdraw the gains over time on a systematic monthly plan. She looks at the annualized returns of 6% over a full market cycle and decides to withdraw 5% every year, knowing there will be annual fluctuations but that over time her principal should be intact.

Retiree B wants to do the same as Retiree A above, but he reviews data from Table B and decides to withdraw 8.5% each year. Because Retiree B is not looking at data covering a full market cycle, he more than likely will dip into principal over time.

Annualized returns can and should be reevaluated periodically to keep client expectations intact. If future returns are consistently less than past performance, adjustments may be needed.

The S&P 500 has annualized 11.29% over the last 70 years (12/31/1948-12/31/2018). But the annualized return over the last 20 years (12/31/1998-12/31/2018) is 5.61%. 1

An investor with 10+ years to go before retirement may need to contribute more money annually and/or rebalance his/her portfolio more aggressively. For investors in retirement, they may have no choice but to start withdrawing less money until markets show signs of improvement.

At Spectrum Financial we evaluate client portfolios at least annually to ensure goals are being met, however, our Investment Team monitors the portfolios on a daily basis. We let clients know the various options available to them so they can stay on track. Annualized returns are an important part of helping clients reach their goals but are only a part of the equation. Please call our office to discuss this topic in more detail for your specific retirement goals.

1 Bloomberg data