I recently spoke to a prospective client who told me a story of a regrettable decision he made over ten years ago. His advisor of many years was retiring and recommended that he talk with someone at Spectrum Financial about active management. He never made the phone call. Instead, he decided in late 2007 to invest his portfolio with a local advisor who was a good friend of his. His entire portfolio was invested in an S&P 500 Index fund. A few months later, in early 2008, his real estate business started slowing down with the weakening economy. In early March of 2009 his equity portfolio was down over 50%. His advisor told him everything was going to be just fine, that “these things happen”.

In 2007 there were over 31 million retired workers receiving Social Security checks. Many of them relied on their investment portfolios to supplement their monthly fixed income checks. Investors have always been told that withdrawing 4-6% annually in retirement is fine to maintain principal. With the severity of the 2008 market losses, many workers who were ready to retire had no choice but to continue working as their retirement savings were obliterated. Investors in the S&P 500 at the high in October 2007 nervously watched as the bear market unraveled and then had to wait almost 5 years before their portfolios recovered from the large losses in 2008. That meant working 5 years longer for many would-be retirees. That, or retiring with a diminished standard of living.

Notable bear markets over the last 90 years:

- The Dow lost 90% of its value in the 1929-32 bear market, 30 billion dollars of wealth was lost. It took 25 years for the Dow to regain its 1929 highs. 1

- The Dow lost 22.6% on October 19th, 1987, “Black Monday”. Five hundred billion dollars of wealth was lost on that day alone in the Dow. 2

- The Nasdaq declined over 78% in the 2000-2002 bear market. Almost 8 trillion dollars of wealth was lost. 3

- The S&P 500 fell over 55% in the 2007-09 bear market. The stock market erased $6.9 trillion in shareholder wealth in 2008 alone. 4

Even worse than the situations above were the individual investors who finally sold their equity positions in the most volatile months of 2008, September and October. There were numerous intra-day losses in the market of over 10%. Investors capitulated and put their entire portfolios in cash just before the start of the next great bull market. Many investors stayed out of the market all-together in 2009. When many finally went back in, they invested in more conservative bond funds that have only had moderate gains in recent years. Many investors are just now getting back to portfolio values last seen in late 2007.

Fast forward to September 2018. The S&P 500 Index enters its longest Bull Market ever. Did I say EVER? The quote most attributed to Benjamin Franklin “But in this world nothing can be said to be certain, except death and taxes” is almost complete. If he were alive today he would surely add “and bear markets”. It’s been over ten years since investors felt any real pain from market losses. Many prospects I talk to have a distant memory of 2008. Some seem to think it never happened or will never happen again. Full-time employees under the age of 32 have never seen anything but a wonderful bull market pushing their retirement accounts higher and higher.

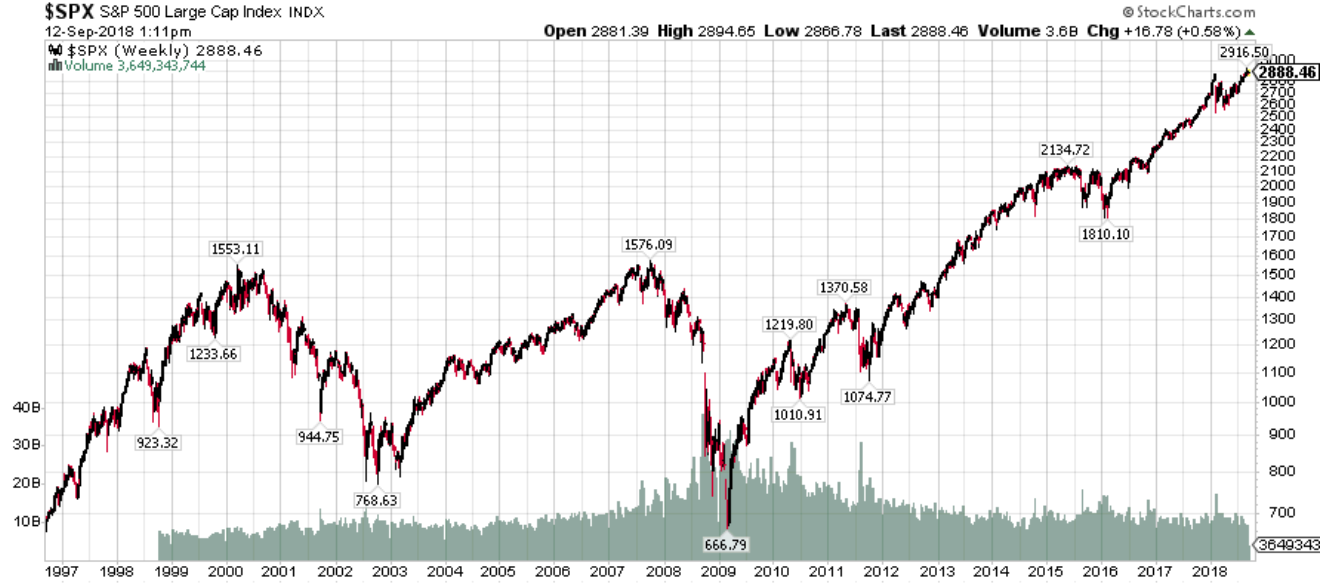

From 1997 to early 2013 the S&P 500 went up and down in a sideways pattern. Your $100 investment in 1997 was worth $100 in early 2009. Your $100 investment in January 2000 was worth $100 in early 2013. This is assuming you didn’t make any redemptions for 10+ years. As you can see in the chart below, the S&P 500 broke out of this sideways channel about six years ago and hasn’t looked back. The bad news is that if the S&P 500 has a similar drawdown as the bear markets described above, it will fall back to levels we last saw in 2007 and 2000. The “lost decade” would then become the “lost two decades” for buy and hold investors.

Created with StockCharts.com. © StockCharts.com, Inc. All Rights Reserved.

Created with StockCharts.com. © StockCharts.com, Inc. All Rights Reserved.

There are numerous possible situations that could trigger the next bear market. A few possibilities are listed below:

- Current Margin Debt

- Threat of global war, including nuclear

- Future elections; change in congress (new economic policies)

- Bull-market fatigue (currently in longest bull-market ever)

- Rising interest rates

- The next “fill in the blank” bubble

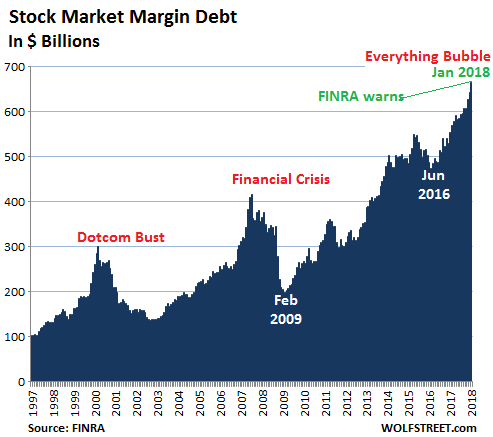

One of the most interesting and not talked about in the general chatter is margin debt. Margin debt is the amount that individual and institutional investors borrow from their brokers against their portfolios. That current debt is over $650 billion (see chart below). Leverage like margin debt helps accelerate the market on the way up because it creates new liquidity to buy stocks. But it is also a great accelerator on the way down, as investors are forced to sell their positions that were bought on margin. Liquidity dries up and the bears come out of hibernation! The current margin debt is more than twice what it was just before the 2000-02 bear market! This is worrisome.

New or soon-to-be retirees need to be aware that the next downturn will come, and they need to be positioned to weather the storm. At Spectrum Financial our AssetMaxxSM and SecurityMaxxSM services employ active management. When the market is steadily moving higher we want to participate. When the market moves lower we want to reduce exposure in our client portfolios and minimize the risk associated with corrections.

I encourage everyone to read our quarterly newsletter “The Full Spectrum”, which can be found on our website www.investspectrum.com. On our homepage, use the top navigation bar, click Resources and tab to “Our Newsletter”. Of special interest related to the topic of bear markets, you can read our late 2008, early 2009 newsletters. This will give you a better appreciation of our thoughts and actions during bear markets. As Ralph Doudera said in our January 2009 newsletter, “Bear markets are painful”. At Spectrum Financial we want to help our clients reduce that pain.

Footnotes: 1 Stock Market Crash of 1929 Facts, causes, and Impact, Kimberly Amadeo, Thebalance.com 2 Black Monday – the Stock Market Crash of 1987, Jesse Colombo, Thebubblebubble.com 3 The Dot Com Bubble Burst That Caused The 2000 Stock Market Crash, Thomas DeGrace, StockPicksSystem.com 4 America Lost $10.2 Trillion in 2008, John carney, Business Insider