When it comes to analyzing new investment opportunities or your current investment portfolio allocation there is more than just performance to consider. Many of us hire financial advisors or use brokers so we do not have to think about the other important statistics, but knowing just enough and asking your advisors, or even yourself, the right questions is important for safeguarding your investments. After all this is your money, and many times a portfolio represents your financial dreams. The investment world has some confusing terms and complicated statistics. Your broker, financial planner or financial advisor may use words like beta, total return, r-squared or standard deviation. These statistics are often times found on mutual fund and ETF fact sheets. Many times, we just want to know “Did I do well? Did the investment or my portfolio do what it was supposed to do?”. These types of statistics can give you that information and reveal if you took on more risk than necessary. For example, various statistics can identify if your fixed income fund or equity ETF was more volatile than an alternative investment option that had the same or similar return. This blog article introduces and gives a general overview of 5 performance measures/statistics that you should understand when it comes to evaluating your portfolio: total return vs. annualized return, standard deviation, beta, and r-squared.

Total Return vs. Annualized Return- How much did I/it make?

Everyone wants to know: “How well did I do this year?”. A return is calculated by taking the ending value of your portfolio and subtracting it by the beginning value of your portfolio and dividing that number by the beginning value. This can be done for multiple time frames.

If you started with $10,000 in your portfolio and 24 months later the value of your portfolio was $15,000 (assuming no additions or withdrawals) what is your return?

- $15,000-$10,000 = $5,000

- $5,000/$10,000= .5

- Your 24-month return is 50%

The 50% is also called your Total Return for 24 months- not bad! But what is your annualized return? For that calculation, you need to know what your total return was each year that the 24 months represents. This may be an over simplification but illustrates the point.

- 2016 your portfolio had a total return of 3% and in 2017 your portfolio made 47%

- 3% + 47% = 50%

- 50%/2= 25%

- Your annualized return is 25%!

But wait, did you make 25% each year? No, you did not. Think of your annualized return as your simple average, because that is the way it is calculated. You could make 0% one year and 50% the next year and your annualized return for your portfolio, or for an investment, will be 25%.

Note: Be careful when looking at annualized returns and understand that it does not mean that the annualized return is how much you will make, or did make, every single year.

You should always look at the time frames and the total return numbers per year to get a better understanding of how the investment/portfolio performs. This is also why you should be aware of a few other statistical numbers to better evaluate your portfolio or an investment.

Standard Deviation- How much does the return fluctuate?

The standard deviation of an investment, or your portfolio, is also known as its historical volatility, or fluctuation, in returns. It is a measure of the dispersion of a set of data from its mean. Stated otherwise, taking the average return for that investment how much did the other returns deviate from the average? Let’s use our return example from before and add on some more years.

- 1 Year Returns: 3%, 47%, 8%, 0%, 2%

- Total return (16,000-10,000= 6,000/10,000= 60%)

- Annualized Return= 60%/5years= 12%

- Standard Deviation= 19.79

What does 19.79 represent? Generally, the smaller the standard deviation the less variance there is to the average return. The higher the standard deviation, the greater the variations to the average return. Our example shows that there is a large difference between the 12% annualized return and the actual total return per year.

If you see a high number, then historically this investment can be very volatile. Depending on your tolerance for volatility and risk this may or may not be important to you.

Always remember, that past performance does not guarantee future results. Also pay attention to the time frame of these statistics. In our example, we based the standard deviation on 1-year calculations. Typically, 3-5-year calculations are used.

Beta- How volatile is the investment compared to its benchmark?

Beta is a comparative statistic, and measures the volatility of an investment/portfolio compared to a benchmark.

*A quick word about benchmarks, if you have invested in a fixed income fund that only invests in municipal bonds do not compare it to the S&P500, compare it to a municipal bond index. The principal is to compare apples to apples. The S&P 500 is an equity benchmark that only represents 500 of the largest companies that are publicly traded. Did you know that there are over 5,000 publicly traded companies that represent just the domestic (US only) equity market? And equities (stocks) are different from fixed income (bonds) in the way these investment products are structured and what influences their value.

Back to beta and how it measures the volatility of an investment compared to a benchmark. Why would you want to know this? Wouldn’t you like to know if you are invested in something that takes on more risk than another investment that has the same return? Beta is another puzzle piece to fully understanding, “How well did I do this year?”.

For this statistic, the market’s (chosen benchmark) beta is set at 1; a higher beta than 1 is considered to be more volatile than the benchmark, while a beta lower than 1 is considered to be less volatile.

Here is an example: If a fixed income mutual fund shows a beta of .83 or 83% as volatile as compared to the Barclays Aggregate Bond Index (benchmark used in this example) over a 3-year period, then it means the volatility was 17% less than the index (less because the beta is lower than 1 and 17% less because 1-.83 is .17). This is an important statistic to understand and know when you would like low volatility in your investments and/or portfolio.

R-Squared- How similar is this investment/portfolio to a benchmark?

R-Squared is a measurement of how closely an investment’s or portfolio’s performance correlates with a benchmark or index. The number can range between 0 and 1. An r-squared of 1 indicates perfect correlation, while a 0 indicates no correlation. For example, if I hold the S&P 500 index ETF my understanding is that it should mimic the S&P500 Index due to the ETF’s stated objective. For this investment I would like to see an r-squared of 1 or a number very close to 1. If I hold an actively managed fixed income mutual fund the r-squared should fluctuate with the fixed income market movements because it is actively managed. R-squared can tell me how the fund’s performance correlates to its benchmark. This is an important statistic to understand and know because it reveals valuable information.

Let’s use our example of the actively managed fixed income mutual fund.

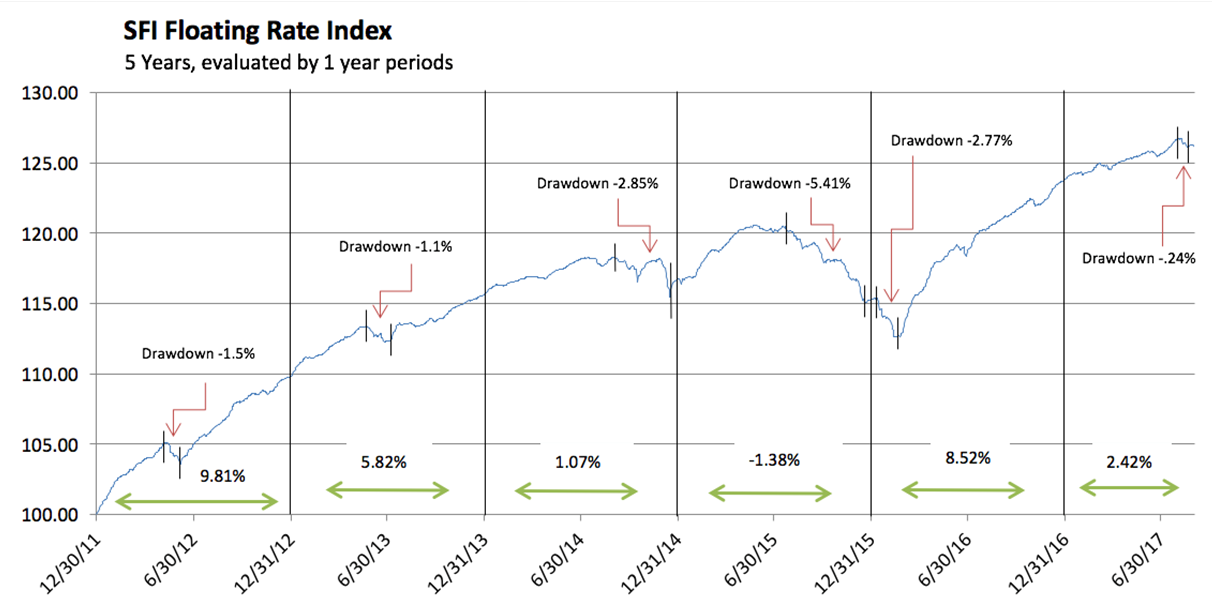

The purpose of an actively managed fund is to lower or limit exposure to downside movements or drawdowns within its investable market, and then to expose the fund, or become invested, when the investable market is rising (this is how you make money after all!).

If the fixed income market is having a drawdown period, or bear market, I would want my r-squared statistic to show very low correlation because that means my returns for that time period are not similar to the market or benchmark. If it was correlated that would mean my investments or portfolio are having a drawdown period too, and that is not good. During a bull market, or a rising market, I would want my r-squared statistic to show a strong correlation because that means my investment’s or portfolio’s return is acting similar to the fixed income market or benchmark.

Know that you need to understand the purpose of your investment (mutual fund, etf, etc.) and its stated objective, and also have a clear understanding for what you want your investment or portfolio to look like and act like.

This will determine how you read and interpret the r-squared statistic.

Understanding what you are invested in and how well you did is very important. This blog article was an introduction to just a few different types of statistics and performance measurements that come in handy in evaluating a potential investment or a group of investments in your portfolio.

Limiting your focus to only performance may mislead or skew your analysis and lead to poor investment choices: either passing up a good investment or investing in a bad one.

The time frames used when calculating these statistics must be understood as well. Investing is personal and subjective. Before you begin investing or analyzing an investment with these statistics, first ask yourself how you would like your portfolio or investments to act. What types of drawdowns are you comfortable with? What types of returns would you like realistic to your personal risk tolerance? After you know what you want and what type of risk you can tolerate, these statistics help guide you to choose the most suitable investments. The statistics and performance measures we covered today were: total return vs. annualized return, standard deviation, beta and r-squared. The statistics on mutual funds or ETFs can change unintentionally overtime as portfolio managers perhaps lose their “mojo” or an investment becomes unsuitable for your current financial objectives. Spectrum monitors and analyzes the changes in these statistics to provide active management which is suitable for the current market conditions. If you have any questions regarding your current portfolio allocation or would like more information on our products, feel free to give our office a call!