Spectrum continues to get many questions about investing in bonds in a rising interest rate environment.

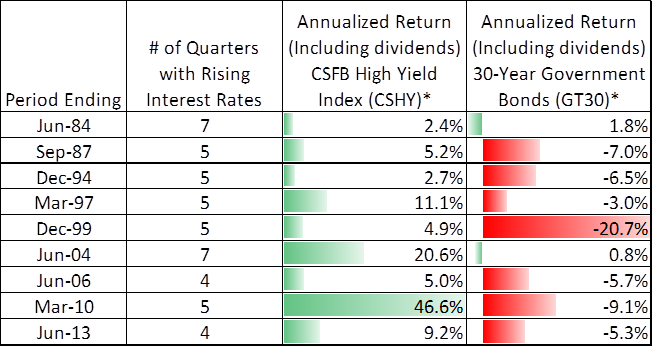

The study below shows an updated chart illustrating every period of rising government bond rates for four or more quarters since 1982. These results show that while government bonds can have loses due to interest rate risk, high yield bonds can have gains.

The CSFB High Yield Index (CSHY) is designed to mirror the investible universe of the $US-denominated high yield debt market. *Data obtained from Bloomberg.

The CSFB High Yield Index (CSHY) is designed to mirror the investible universe of the $US-denominated high yield debt market. *Data obtained from Bloomberg.

The primary reason for this is that interest rates generally increase when economic indicators are improving, causing government bond prices to go down. However, an improving economy reduces the risk of owning high yield bonds because they should strengthen as their credit rating improves. High yield bonds act more like stocks than bonds in a favorable economic environment. This is consistent with the Federal Reserve’s commitment to keep rates low until the economy is stronger.

We believe high yield bonds should have more room to continue to be profitable in any case.

An impending recession would provide reason to reduce high yield bond exposure due to the fact that risk of default is high. By moving to a cash position when a recession becomes likely, we will be in a position to reinvest the funds and take advantage of a purchase at much lower prices. Currently high yield bonds offer a yield of 3.6% more than government bonds.

This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Spectrum Financial, Inc. in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Spectrum Financial, Inc. expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. For full disclosure please see disclosures page here.