General Market Commentary

The financial markets have been responding well to the Federal Reserve’s threats of interest rate hikes. In addition, the bull market is overdue for a correction, but it continues to climb the wall of worry. Since 1932, stock prices have had 30 corrections in excess of 10%; about one every two years. It has now been about 15 months since the last one in February of last year.

Many indicators are showing strength, such as the Consumer Confidence Index, which is the highest since 2001, and the Measure of CEO Confidence, which is the highest since 2004. Investor confidence is still not at excess levels, and until the market gets overly confident, there could be more gains ahead.

The Russell 2000 Small Cap Index shows the performance of the smallest 2000 companies of the Russell 3000 Index. This index is only up 2% year-to-date through April 21, whereas the NASDAQ 100 Index (large-cap) is up 12%. For this bull market to continue, we need to see the smaller companies start to perform. The smaller companies are less liquid, so large investors tend to avoid them unless they become more confident about the financial markets going forward. We will continue to monitor this divergence.

Bull or Bear Market?

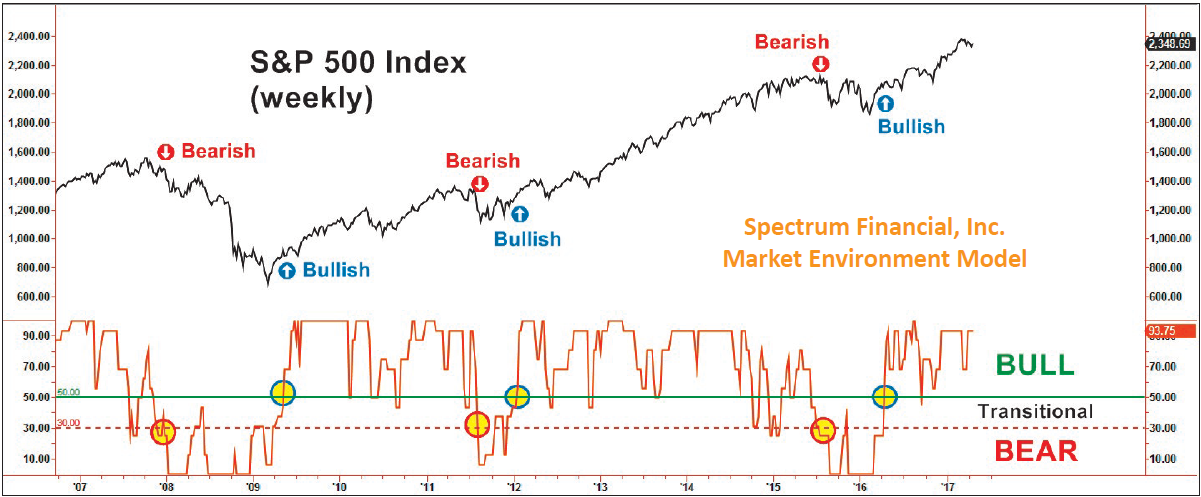

The chart below illustrates our Market Environment Model. This model has indicated a bull market environment since early 2016, following a significant market sell-off beginning in mid-2015. The indicators that we utilize illustrate higher market risk, and can cause us to significantly reduce exposure to stocks. We currently use a proprietary combination of four components: 1) Moving average of major equity indexes, 2) Weekly Directional Movement Index, which defines the quality of the trend, 3) Negative Leadership Composite as defined by Investech, and 4) Spectrum’s High Yield Bond signal, which confirms a healthy economy. These four indicators together are not a forecasting device, but they give us insight into levels of market risk. Depending on this evaluation, we adapt our trading strategies to become more aggressively invested or more defensive to reduce risk. Management of risk has always been a cornerstone of Spectrum’s investment philosophy.

Created with TradeStation © TradeStation Technologies, Inc. All rights reserved

Created with TradeStation © TradeStation Technologies, Inc. All rights reserved

This blog contains excerpts taken from the April 2017 edition of The Full Spectrum newsletter. To continue reading please request a complete copy here: The Full Spectrum: April 2017

Disclosure

Spectrum Financial, Inc. is a Registered Investment Advisor. The Full Spectrum is published quarterly for its investors and account executives. This publication is not intended to offer or solicit investment advice, nor should anyone act upon any suggestions made herein, without individual counseling from your account executive regarding risks involved. There is no guarantee that the recommendations of management will prove to be as profitable in the future, as they have in the past. The information presented in this issue has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. A copy of Spectrum’s current written disclosure statement discussing advisory services and fees is available upon request. All rights reserved, please notify when quoting.

This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Spectrum Financial, Inc. in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Spectrum Financial, Inc. expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. For full disclosure please see disclosures page here.