Making better decisions usually entails some sort of the following:

- Current decisions are not cutting it & you are aware

- Perform analysis on WHY & WHERE in the process things are going wrong

- Get new information for your decision making formula: Alternatives

- Make a different decision

What are the Current Trends?

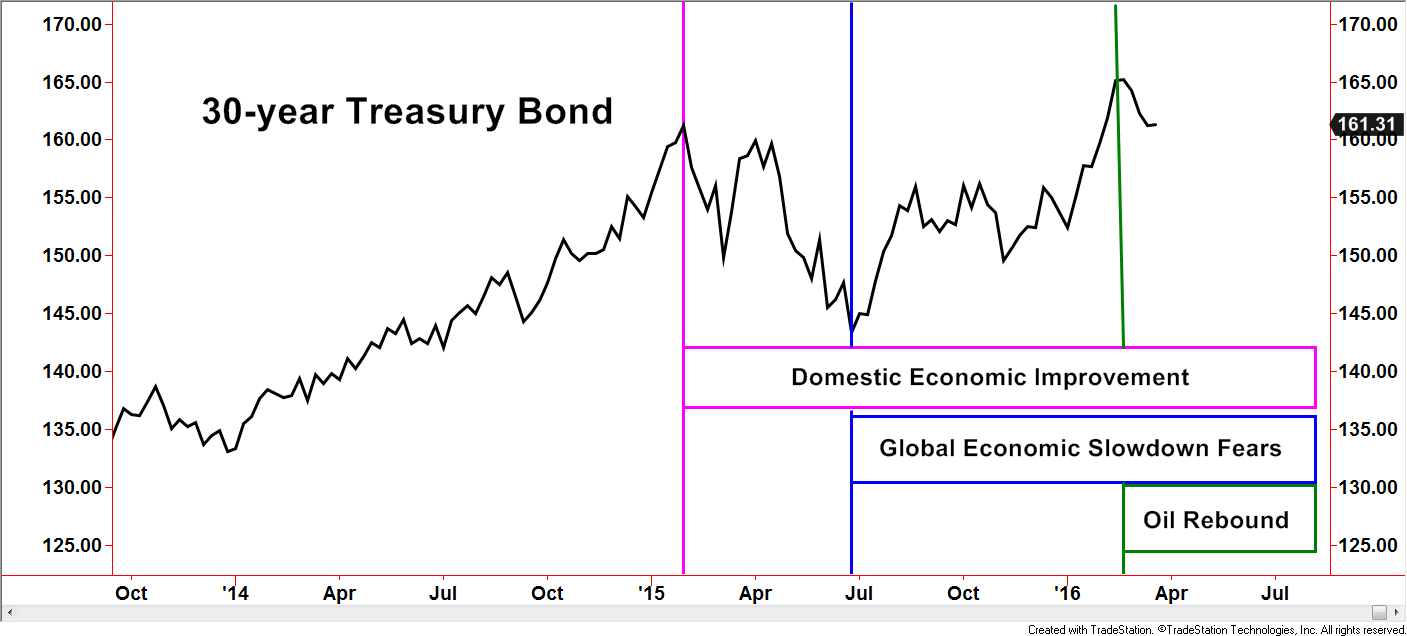

The 30-year Treasury Bond (pictured below) currently reflects the crosswinds of recent headlines. Improvement in the jobs data and consumer spending, while not consistently positive, point to traction in the economy. Some detractors to the positive traction have been the volatility in oil, slowed growth in China, and the threat to global commerce which could restrain the US from achieving a more robust economy. When you have mostly consistent positive improvements but heavy weighted detractors you get a crosswind environment. You can see these factors charted against the 30-year Treasury Bond below.

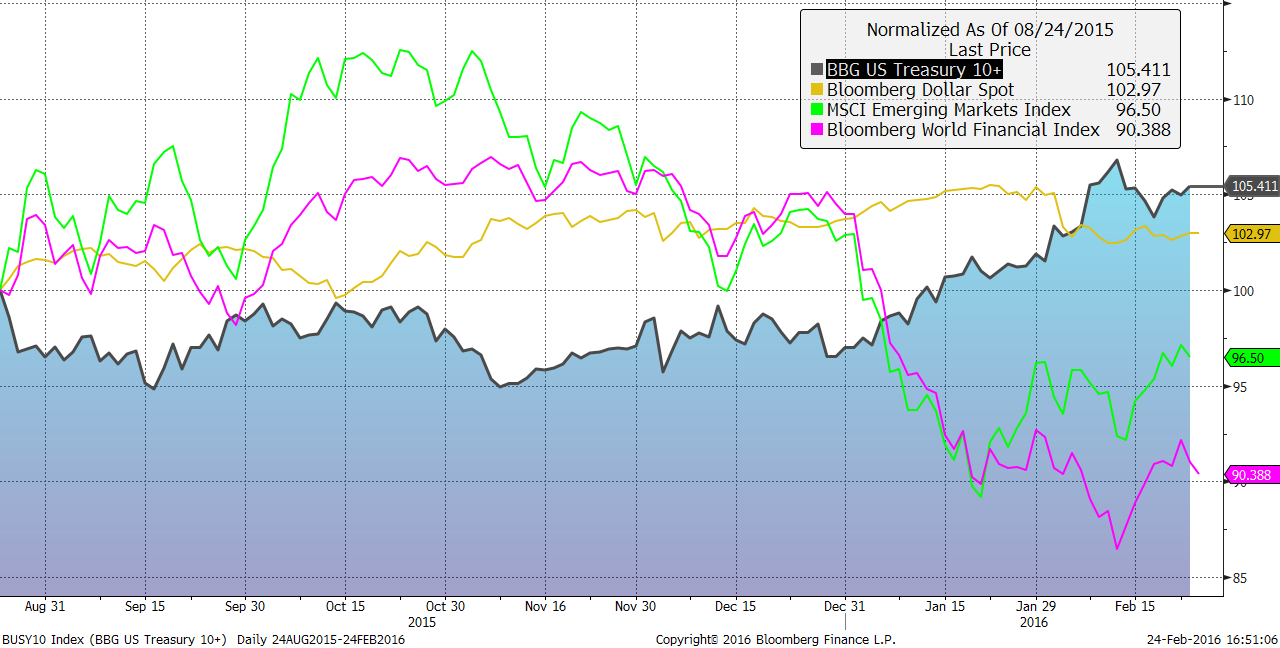

Bond prices tend to trend lower during periods of economic expansion and prices tend to rise during periods of heightened uncertainty. The new environment we are seeing in the markets is a condensed, extreme version of this cycle. Down Up, Down Up.

The chart above displays a large sideways pattern after the steady climb during 2014.

![]() The pink box indicates when investors perceived an improvement in the domestic economic condition starting Quarter 1 in 2015.

The pink box indicates when investors perceived an improvement in the domestic economic condition starting Quarter 1 in 2015.

![]() Since summer of 2015, however, fears of a global economic slowdown were an influence to higher prices and lower yields (blue box)

Since summer of 2015, however, fears of a global economic slowdown were an influence to higher prices and lower yields (blue box)

![]() Over the last month, bond prices have eased lower as oil prices have experienced a mild rebound (see green box).

Over the last month, bond prices have eased lower as oil prices have experienced a mild rebound (see green box).

There are many other factors that have played roles of influencing prices. However, the forces mentioned above seem to have a stronger impact over others, not to mention the additional impacts added daily- much like the recent Federal Reserve Meeting last week.

Blending all these influences together creates the crosswinds that make up the path of the market.

Flexibility & Price Movement

Eventually, the short, intermediate, and longer-term trends will get on the same page but we do not know when that will be, nor do we need to be skilled at such forecasts. (See Why here)

Some investors perform extensive research into macro-economic models, only to be subjected to the crosswinds that can push around bond price. A weakness of macro-economic models is the negative impacts to a portfolio while investors wait for their models to possibly yield desired results. Instead of relying on correct predictions through an economic model, flexible methods rooted in the information derived from price action and sentiment evaluated over different time frames can create better risk/reward opportunities.

The price movement of securities, and in this case bonds, are inclusive of economic impacts whether it is the Federal Reserve, Chinese economics, the oil market, or combination of these events.

For example, further declines in treasury bond prices generally have positive influences on growth assets such as high yield, preferred stocks and domestic equities. Additional signs of economic instability, domestic and foreign, could lead to a rise in treasury bond prices as well as other higher rated bond classes. Methods employed by our management not only assess where to invest but also incorporate the time frame factors of long, intermediate, and short terms.

Successful investing does not require predicting an outcome, but having a sound plan of action in place improves the odds of success

The Take-Away:

How do you make better investment decisions in current trends?

- Know the current market environment for which you are investing

- Use flexible/agile models that evaluate different time frames

- Use tools that are efficient and inclusive of other data like price movement