On Wednesday 4/27/16, the Federal Reserve decided to leave rates unchanged. Pretty uneventful, huh? “Fed watching” is a popular term used by investors to assess the Fed’s actions, or inactions, and how the Fed summarizes vast amount of number crunching as it relates to trends in the economic landscape. Observational analysis can also be taken a step further by assessing the reactions in the stock and bond markets.

What the Fed Said

First let’s take a look at what they said and then we can attempt to read between the lines. They acknowledged economic activity slowed its pace of growth in pretty much all areas other than the housing market.

Their rebuttal against alarm was based on the consistently improving jobs market and the future spending power that should bring.

Speaking of spending power, consumer spending increased at a 1.9% rate which not only was lower than the 2.4% increase in Q4, 2015, but was the slowest since the first quarter of 2015. An argument can be made that because it accompanied a higher savings rate and lower consumer debt numbers, the dip could be akin to a “pause that refreshes” ahead of another expansion of spending. Decreased spending, if accompanied by weaker employment and higher debt levels, could establish a trend toward consumer defensiveness but again, that was not the case.

The Federal Reserve also noted their concerns of threats to the global economy have diminished.

Ultimately, the lack of rate change sent the message of a domestic and global economy that is not too hot and not too cold. Both extremes could have led to market shocks in various ways.

A Calm Reaction from Markets

The stock and bond markets often have sharp reactions to the Fed comments but the stock and bond markets were relatively calm. Treasury yields did fall (prices rose) after the announcement on Wednesday but probably not for reasons of investors fearing recession. From the perspective of US investors, treasury bonds tend to be less attractive than growth assets during periods of overall economic improvement. Put another way, the perception of ongoing economic weakness would generally have treasury prices rising (yields falling), accompanied by weakness in the stock market.

But treasuries prices did rise on Wednesday – what gives!?!

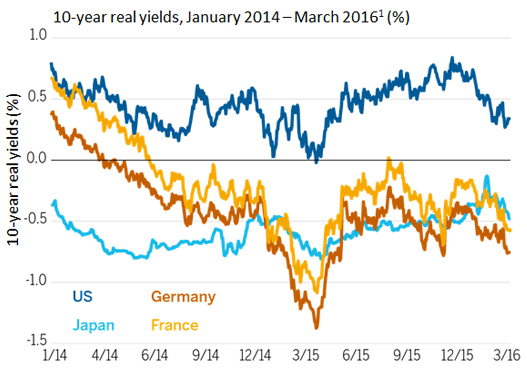

Investing globally has become easier and easier. That means analysis must take into account the ripple effects across asset classes and across geographic borders. The chart below shows that while the 10-year yields in the US are low, and perhaps not very attractive to US investors, yields are much more attractive when viewed from the perspective of foreign investors.

Simply put, the reaction to the Fed and the general resilience of treasury bonds in recent months may have more to do with favorable relative yield globally as compared to being the destination of those fearing a trend toward a weaker US economy.

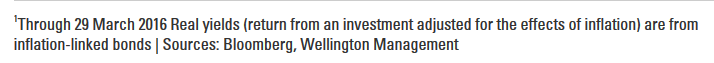

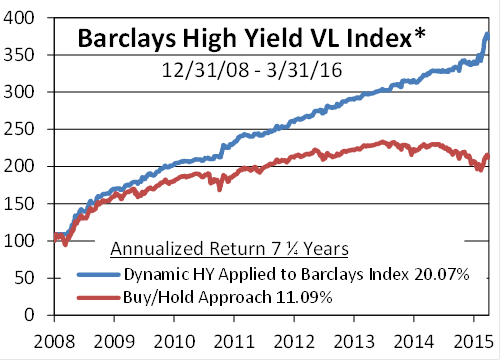

As stated, fear of a weakening US economy would generally be evident in weakness within the stock market and bond categories traditionally sensitive to growth. The charts below display upward sloping shorter-term trends in the stock market, high yield market and bank loan market. The CBOE/S&P Volatility Index (VIX) is often called the “Fear Index”. It trended lower in the period. All four of these measures convey bullish investor sentiment, not concerns of a slowing economy.

General consensus had the Fed raising rates approximately four times in 2016 which played a role in the rocky start of the year in equities and flight to quality bonds.

Those price trends have since been reversed as the recent consensus points toward approximately two rate increases this year.

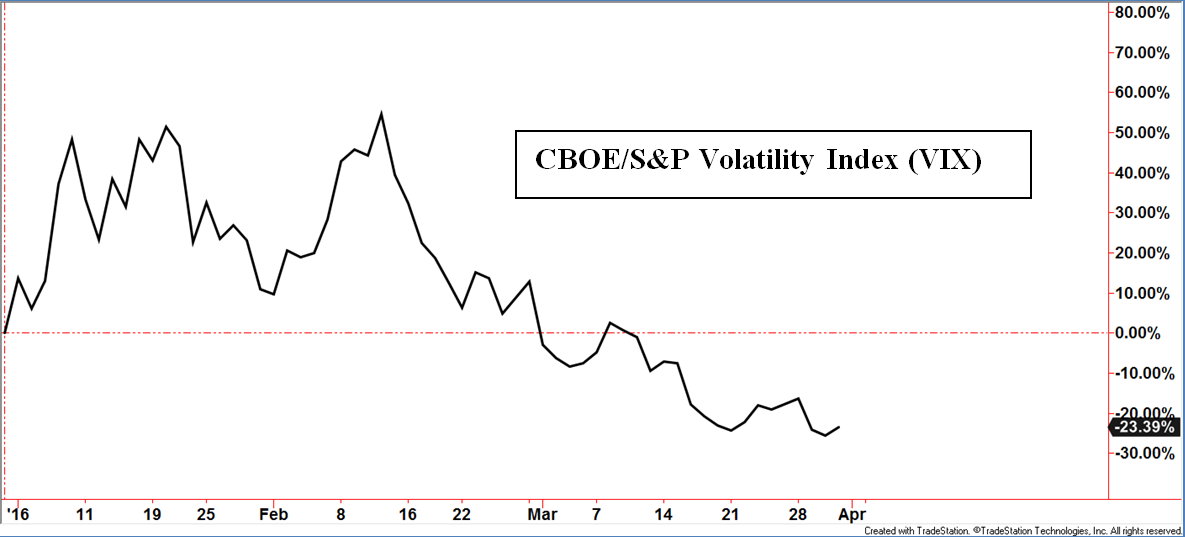

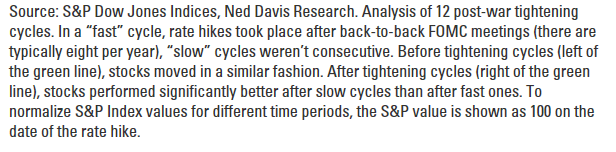

So if the environment is implied to be at a slower pace of interest rate increases, what would that mean for the markets? We don’t want to over assume the future but we can use history as a general guide.

The chart above shows that historically, rising rate cycles have caused increased volatility versus the period prior to the tightening cycles. However, the speed of increases had the stock market taking on different trend characteristics. The slower tightening cycle had a more desirable outcome for equity investors versus the jagged sideways path during periods of faster tightening cycles.

Actions or inactions by the Fed combined with assessing market reactions can give deeper insight into the true health of the economy and possible paths of the stock and bond markets.

Disclosures

Standard and Poor’s 500 TR Index (S&P500) is a capitalization-weighted index of 500 stocks representing all major industries.

The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices.

10-Year Real Yields Real yields on Treasury Inflation Protected Securities (TIPS) at “constant maturity” are interpolated by the U.S. Treasury from Treasury’s daily real yield curve. These real market yields are calculated from composites of secondary market quotations obtained by the Federal Reserve Bank of New York. The real yield values are read from the real yield curve at fixed maturities, currently 5, 7, 10, 20, and 30 years.

This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Spectrum Financial, Inc. in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Spectrum Financial, Inc. expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. For full disclosure please see disclosures page here.