A Beginners Guide to Buy Low, Sell High

“Buy low, and sell high”, is foundational advice often given to beginning investors in order to avoid losses and lock in gains. In an attempt to reach that goal, a portfolio manager often draws from the discipline of technical analysis which at its core, focuses on the effects of buying and selling pressures on assets such as stocks, bonds and commodities. Technical analysis is often contrasted against fundamental analysis which focuses on gauging the financial health of a specific company or industry. The two can also be blended, introducing an additional discipline, economic analysis. This post will explore the technical analysis discipline which is diverse. However, most technical analysis tools can be separated into either trend following or mean reversion categories.

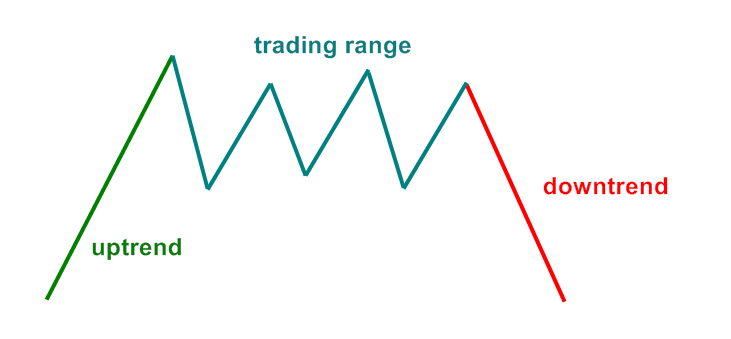

Understanding how markets move

Markets have two states of movement, either trending up/down or rangebound. A portfolio manager must first use indicators specific to identifying the two states of movement. Think of these technical analysis indicators as tools. Having the right tools for the job plays a significant role in the success of the overall investment process. Like using a hammer to drive a nail or a shovel to dig a hole versus using the shovel to drive a nail and the hammer to dig a hole. Once an environment is identified, more specific indicators and methods can be used which may reveal further information about the environment.

Indicators of market movements

Indicators are available to detect various traits of price movement. If “Point Z” is higher than “Point A”, then an uptrend may be present (though what happened in between could play a role in the investment decision). Trends may be steady or could be choppy. Even within a choppy uptrend, it may have various degrees of width in the swings. Indicators exist that simply define a trend as being positive or negative and tools exist that define the level of volatility within the trend. Rate of change indicators can identify the percentage movement over a specified time period in order to identify trend. These indicators also display momentum or if the trend is speeding up or slowing down. Why does all this information matter? The more informed you are as to what is going on with a market environment the better equipped you may be to make risk-adjusted decisions for your portfolio.

Moving Averages

Moving averages (displayed below) are popular ways to identify trends because chart readers can easily see if the asset is above the moving average or below. If the asset is above the moving average the trend can be defined as an “uptrend”. If the asset is below, it can be labeled as a downtrend. The number of days used to calculate the moving average can vary in order to detect trends of various time frames such as shorter-term, intermediate or longer-term.

Mean Reversion

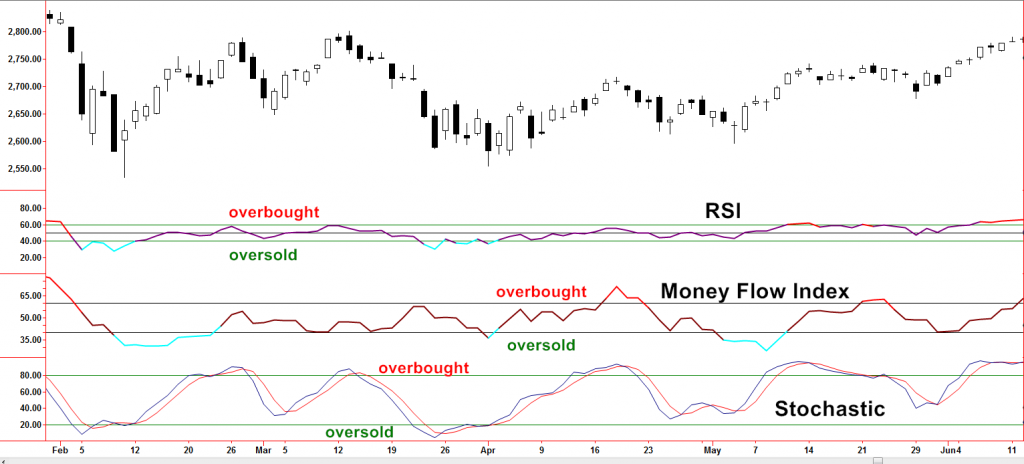

The “buy low and sell high” concept can also be conveyed through mean reversion methods. In case that term is new to you, mean reversion simply means the movement is stretched, gone further than it typically does, and may soon snap back. “Overbought” and “oversold” are common terms associated with mean reversion methods. If a stock is in a trading range, by definition, it reaches an upper point, or extreme and then goes down toward a mean or average. It may then overshoot and go to a lower extreme, becoming oversold and then revert back higher. This process may be repeated numerous times. Trading ranges may be after an uptrend or downtrend has slowed. These may lead to a full reversal in overall direction or the trend may eventually resume but at a different slope. Once a trading range is identified, a portfolio manager must then be able to identify what constitutes the extremes or overbought and oversold zones. Tools of the trade may include Stochastics, Money Flow Index, and RSI, among others (pictured below).

Volatility Analysis

Tying the states of trending and trading ranges together may also involve volatility analysis. If volatility is high enough a trend may be observed and at the same time, upper and lower extremes can too. These are often referred to as trend channels (see below). Modest adjustments to exposure are often the goal when trend channels are identified such as the adding of positions around the lower channel line or “profit-taking” near the upper channel line.

Why does this matter?

Many investors take a hands-off approach to investing but that puts hard-earned money at the whims of the changing trends, and some bear market trends can be devastating. Active portfolio management, by way of technical analysis, often includes implementation of the tools discussed above. These tools detect periods of trending or trading ranges. Refinements with more specific trading tools and methods within those periods can further increase odds of potential success in navigating the unknown waters yet to be seen. This comprehensive approach to investing is used in Spectrum’s management for its clients.