As we get close to graduating from High School/College we quickly realize that working for at least the next forty years is a stark reality. We have bills to pay. Many of us invest in our company retirement plan or start a Traditional or Roth IRA. In most cases the overall goal of our lifetime investing is to be able to retire comfortably. Our expenses do not stop once we retire. Social Security checks are a supplement, but one that most individuals will have a hard time living on. According to the SSA.gov website, the average retired worker receives just over $1,500 each month. So, we turn to our retirement account to make up the difference.

One of the first questions that I hear from clients is “How much can I withdraw every month and not run out of money?” First, you need to decide what your end goal is. Do you want to spend your last penny on your death bed? Do you want to maintain the principal and forward the balance to your children and/or charity? Or do you want to grow your account as much as possible, regardless of how little you may be able to withdraw?

Outside of health, nothing is more fearful in retirement than the thought of running out of money. As a rule, I tell clients that withdrawing 4-5% per year is the best conservative option. Some historical numbers can explain my reasoning. From 12/30/1929 to 12/31/1999 the S&P 500 Index had an annual rate of return of 10.47%. From 12/31/1979 to 12/31/1999 the same index annualized 17.85%. Based on these numbers I should be able to withdraw 10% per year and be just fine, right? Well, so far this century (12/31/1999 to 10/30/2020) the S&P 500 has annualized only 5.94%. If the last twenty years is the “new norm” then taking 4-5% annual distributions is probably a safer route than what many investors were used to before the turn of the century. The above S&P 500 returns were calculated using ©Bloomberg software.

A very common and practical way to take annual withdrawals is by taking a fixed percentage that remains constant throughout your lifetime. If you take 5% per year (monthly withdrawals to live on) you will get more per month the following year if your portfolio grows greater than 5% and less per month if your portfolio return is less than 5%. But it is a safe way to ensure that your portfolio will never be depleted. Trust accounts employ this strategy frequently to ensure the beneficiaries won’t squander the proceeds.

Another very practical way to look at withdrawals in retirement is like the example below. Many times, the conversation goes as follows:

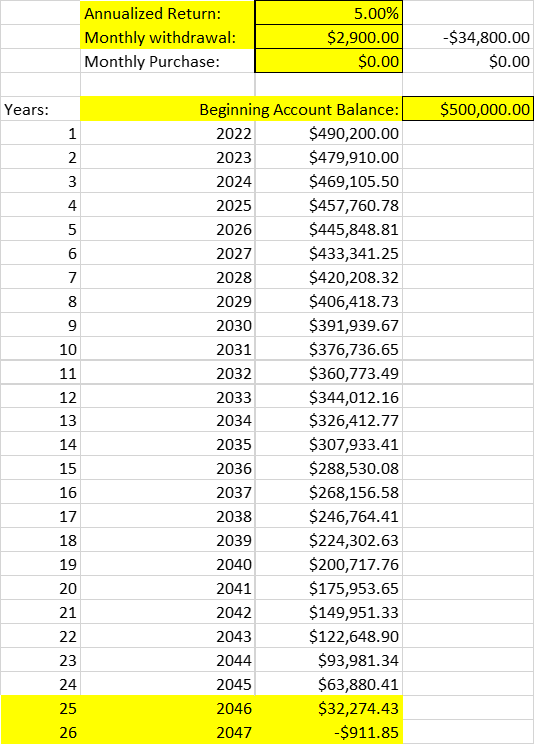

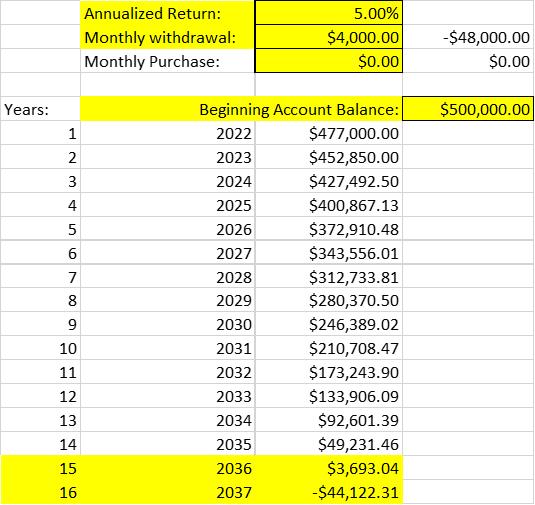

“I have $500,000 and need to withdraw $4,000 monthly. Will it last me 25 years?” I created a simple calculator that is very useful in giving clients realistic expectations based on their starting portfolio value and monthly withdrawals. I usually use 5% as an annual rate of return. These three numbers can be adjusted annually based on current value. Based on the hypothetical question above, you can see the results below.

In the case above, it is unrealistic to believe that withdrawing $4,000 per month will last 25 years. Based on a 5% annual rate of return, this client’s portfolio will be depleted in about 15 years. “So how much can I withdraw for the next 25 years?” Again, by adjusting the monthly withdrawal in the calculator we come up with an answer of $2,900 per month.

Again, the above example is using a conservative rate of return based on what the market has done over the past twenty or so years. If returns are bigger going forward the portfolio will last longer.

The examples above are just a few of many possible examples out there. Every client is different. Preparing early is always the best approach to avoiding disappointment in retirement. I would encourage you to call our Client Services Team at Spectrum so we can discuss your specific goals, whether you are a prospective or current client. You can reach us at 888-463-7600 Monday through Friday from 8:30-4:00 p.m. ET.