Stock markets around the globe reacted by moving sharply lower on Friday, 6/24/16, and again on Monday, 6/27/16. Chart-based or technical analysis-based investors point out that chart patterns and indicators often give warnings ahead of declines. In some cases, however, declines can be swift and without warning. In most cases, these are initiated by news events in which there are very low probabilities of foreknowledge by even a small number of individuals.

Low probability news events can be labeled as “UFOs” or “Unforeseen Fundamental Occurrences”

Terrorist events and natural disasters are the most common “UFOs”. Interest rate changes and currency devaluations can be surprises but in many instances, some clues may be present in price action ahead of the actual event. In many cases, dates of certain news events are known ahead of time but the outcome may be a shock to market participants. Examples of this would be scheduled economic releases, including Federal Reserve policy announcements, as well as earnings releases from major companies. Most recently, the vote for Britain’s possible exit of the European Union was known, but the actual result of the vote obviously was a surprise to market participants.

So how should investors respond to UFOs? Some readers may see it as a blatant omission of valid strategies if not mentioned, but one response is the use of option strategies of varying degrees of sophistication. In this article, however, we are going to focus on a broader, more practical concept.

News events happen on a daily basis which means we need to define UFO shocks versus other times of weakness. For now, we will limit the discussion to downside shocks but the concepts will generally transfer over to upside surprises. Chartists or technical analysis-based investors, can define UFO type of shocks in many different ways. The underlying concept behind technical analysis is that price action, and various market related data, conveys the net stance of market participants – bullish or bearish and the degree of their convictions through buying and selling intensity. Logically, shocks mostly run counter the prevailing trend. With trend following being so popular for charting reasons or fundamental reasons, a large number of investors can be caught off-guard. This results in a herd mentality stampede.

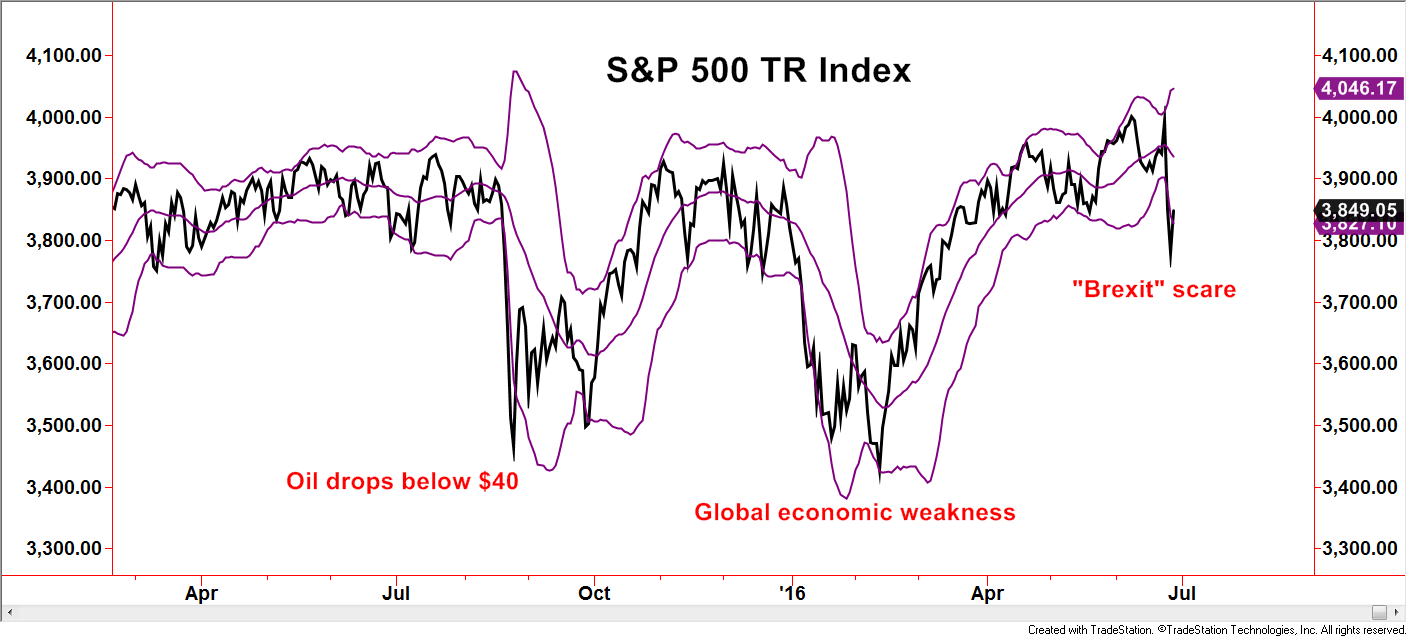

A popular technical choice is the use of Bollinger Bands. These display a moving average with upper and lower lines or bands that respond to the volatility of the underlying investment. Movements outside the bands by the underlying investment, the S&P 500 Total Return Index for example, define rare events relative to the prevailing trend and volatility. The chart below displays a number of these periods in which the selling intensity was robust enough to get the S&P below the lower band. These periods invariably have news events behind them. Notice this method separates the more intense movements, the shocks, versus the more common periods of trending and volatility. Chartists tend to not get overly concerned with the details of the story behind the news, rather, the market’s reaction. Simply put, price movements outside of the bands can define a reaction to an Unforeseen Fundamental Occurrences.

Created with TradeStation © TradeStation Technologies, Inc. All rights reserved

Created with TradeStation © TradeStation Technologies, Inc. All rights reserved

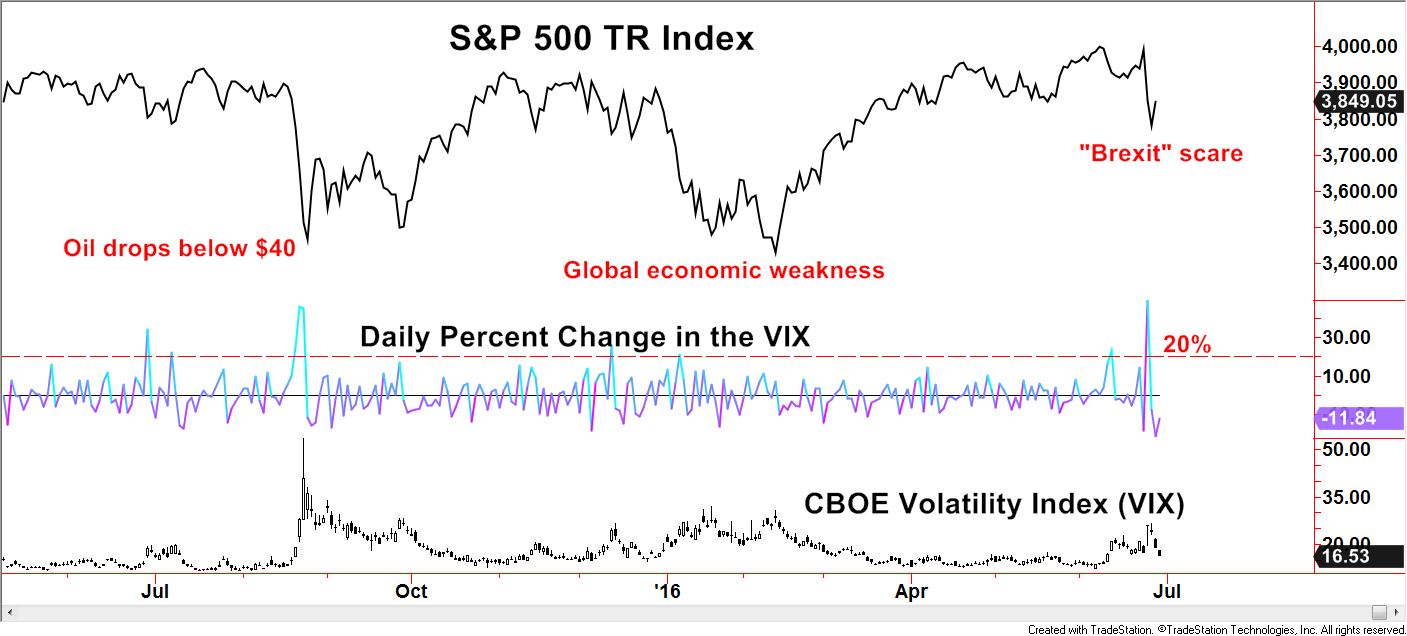

Another popular method is to gauge the CBOE Volatility Index (VIX). The VIX is often referred to as the “Fear Gauge” as it tends to spike during times of negative market shocks. – (See chart below) Even though only two charting methods have been shown, there are numerous ways to define shocks.

Created with TradeStation © TradeStation Technologies, Inc. All rights reserved

The primary reason to have a mechanical or disciplined method of defining these events is because in the moment, emotions from the UFO event tends to cloud judgement. Being able to identify these periods as being out of the ordinary can bring an investor back to the reality of the next step.

“Failing to plan is planning to fail” – Benjamin Franklin

That pithy saying is full of wisdom, especially for the chart-based investor. Once again, how does an investor respond to “Brexit”, a terrorist event, a sharp decline in oil, China lowering growth expectations, or an expected sour economic release? When UFO’s occur, don’t try and overanalyze the content of the news but simply stay focused on your trading plan. Yes, that assumes a trading plan is in place. It is similar to the advice from a doctor or a trainer, “if you want to lose weight, you need to exercise”. Thanks Captain Obvious! This advice may be easier said than done but the goal is to develop a resistance to the emotional knee-jerk reactions that can pull an investor away from a trading plan. A whipsaw may be the result, selling then rebuying soon after, but risk controls must be a priority.

Even if a trading plan is not an unemotional black box, rules based method, a logical, qualitative strategic approach can be applied. For example, setting investment exposure at levels in which the market response in either direction would be acceptable. That way, an investor should not find themselves too far behind benchmarks if a reduction in exposure after a UFO is followed by a surprise rebound. At the same time, if the market continues lower, at least some steps would have already been taken to reduce risk.

Articles related to the “Brexit’s” potential impact to the world’s economy are a dime a dozen right now. Such articles may add color to one’s understanding of the event but the most useful advice may be to simply prioritize the disciplines adherence to an established trading plan.

Disclosures

S&P 500 TR Index: is a capitalization weighted index of 500 stocks representing all major domestic industry groups and assumes the reinvestment of dividends and capital gains. It is not possible to directly invest in any index.

This writing is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by Spectrum Financial, Inc. in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Spectrum Financial, Inc. expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. For full disclosure please see disclosures page here.