Breaking News: Over 270,000 viral deaths globally (over 75,000 in the United States) and it is still spreading. Global economies have been almost completely shut down. Airlines shut down. Entire cities turn in to ghost towns. Stay in your homes. No eggs, meat or toilet paper anywhere. Oil is free.

At first this sounds like the backdrop to a new novel written by Stephen King. But this is the current reality and it could be here for some time to come. To think that only three months ago the stock market was hitting new all-time highs and everyone who wanted a job had one. Kids were all in school learning. Sports fans were happy. Graduations, weddings and vacations were being planned. All was well with the world!

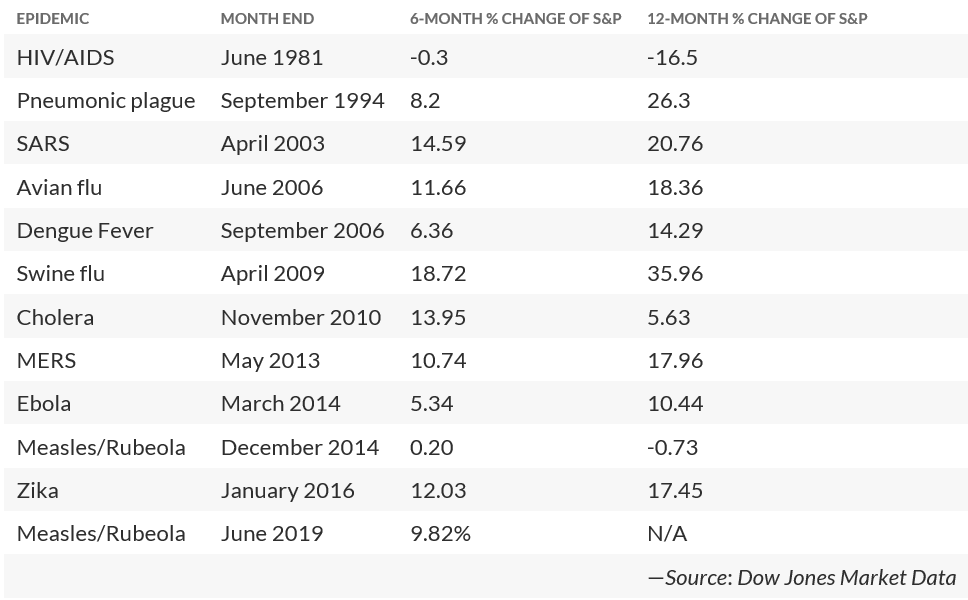

On March 9, 2009, the last Bear Market ended. The ensuing Bull Market lasted eleven years, the longest ever recorded. There is always a catalyst that pushes the stock market over the edge. Everyone has read about the Great Depression, the 73-74 bear market and the Crash of 87’. It was the dot-com bubble in 2000, the real estate bubble/bank-auto bailout in 2007-2008 and now the coronavirus pandemic/oil crisis in 2020.

On March 9, 2009, the last Bear Market ended. The ensuing Bull Market lasted eleven years, the longest ever recorded. There is always a catalyst that pushes the stock market over the edge. Everyone has read about the Great Depression, the 73-74 bear market and the Crash of 87’. It was the dot-com bubble in 2000, the real estate bubble/bank-auto bailout in 2007-2008 and now the coronavirus pandemic/oil crisis in 2020.

Not since World War II has there been such a global event that has affected how all 7.8 billion humans on this planet live their daily lives. During this stressful period, the last thing investors need to worry about is the health of their investment portfolios. Many investors saw 20-60% drawdowns in Q1 2020. Many large-cap companies like Delta Air Lines, Boeing, Carnival and Occidental Petroleum are down 60%+ YTD (through 5/5/20).

At Spectrum Financial our client portfolios are actively managed, every day, all day long. We allocate client money based on their individual risk level, time horizon and personal goals. One of the services Spectrum offers is our AssetMaxx℠ program. It provides access to three distinct actively managed funds for portfolio design. These funds can adjust exposure to the markets based on current environments. At times, these funds may be invested 100% in cash or cash equivalents. Spectrum clients have historically benefited from active management in managing risk. This current environment is no different. In the 1st quarter this year the Spectrum Low Volatility fund (SVARX) was up 1.60%, the Hundredfold Select Alternative fund (SFHYX) was up 4.40% and the Spectrum Advisors Preferred fund (SAPEX) was down 13.02%. The S&P 500 TR Index was down 19.60% and the Barclays High Yield VL Index was down 12.32% during the same period. Standard performance data can be reviewed at https://investspectrum.com/AssetMaxx.cshtml under our AssetMaxx℠ Service, or at each Fund’s website, http://thespectrumfunds.com or http://hundredfoldselect.com/ .

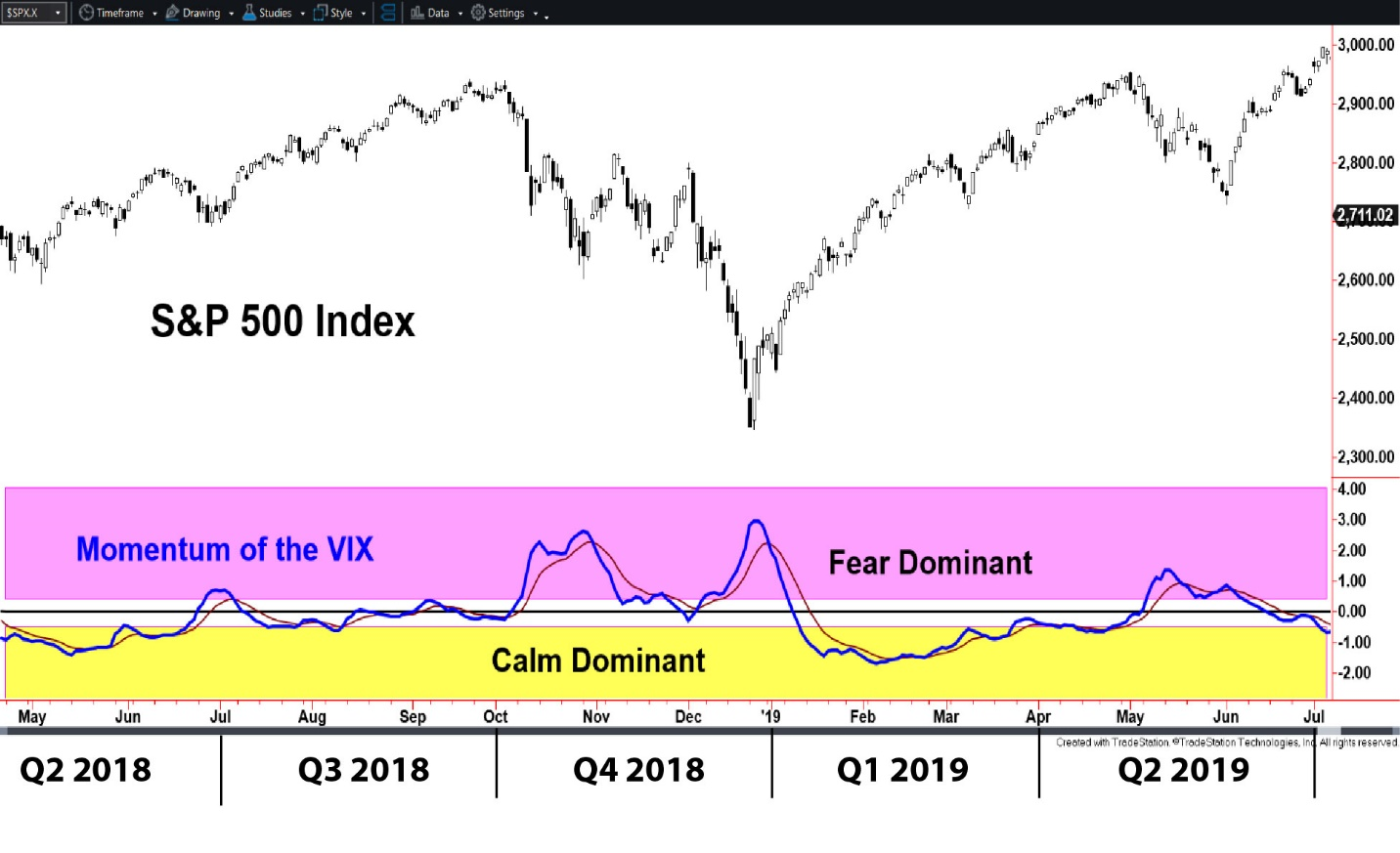

Markets do not like uncertainty. With the ongoing Russia/Saudia Arabia oil feud, the aggressive behavior of Iran and North Korea, the trade war with China and the Coronavirus pandemic, there are plenty of elephants in the room to keep this market nervous and volatile in the short-term. We don’t know when the storm will be over, but our active management helps clients feel secure as we control exposure in this volatile market.

For over 20 years I have worked with Ralph Doudera, the CEO and head Portfolio Manager of Spectrum Financial, Inc. One of my favorite quotes that he has repeated over the years is “I want to sleep good at night, and I want our clients to sleep good as well.” Have you been sleeping good lately?

We encourage you to call and speak with our Client Services team at 888-463-7600 to learn in more detail the programs we offer here. You can also go to our website www.investspectrum.com to learn more about our company, the team and timely updates about the actively managed funds used in our AssetMaxx℠ program.