This blog is taken from our January 2017 newsletter discussing yield spreads.

High Yield Returns

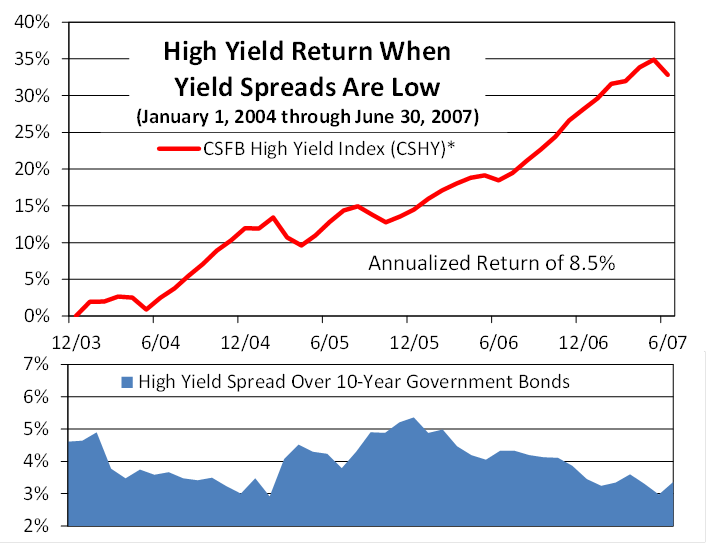

The yield differential between high yield bonds and US government bonds is currently only about 3.8%. This indicates that the yield on high yield bonds is paying 6.3%, where 10 year government bonds only yield 2.5%.

A normal range for this yield spread is between 3% and 7%. The lower this number is, the lower the potential returns are.

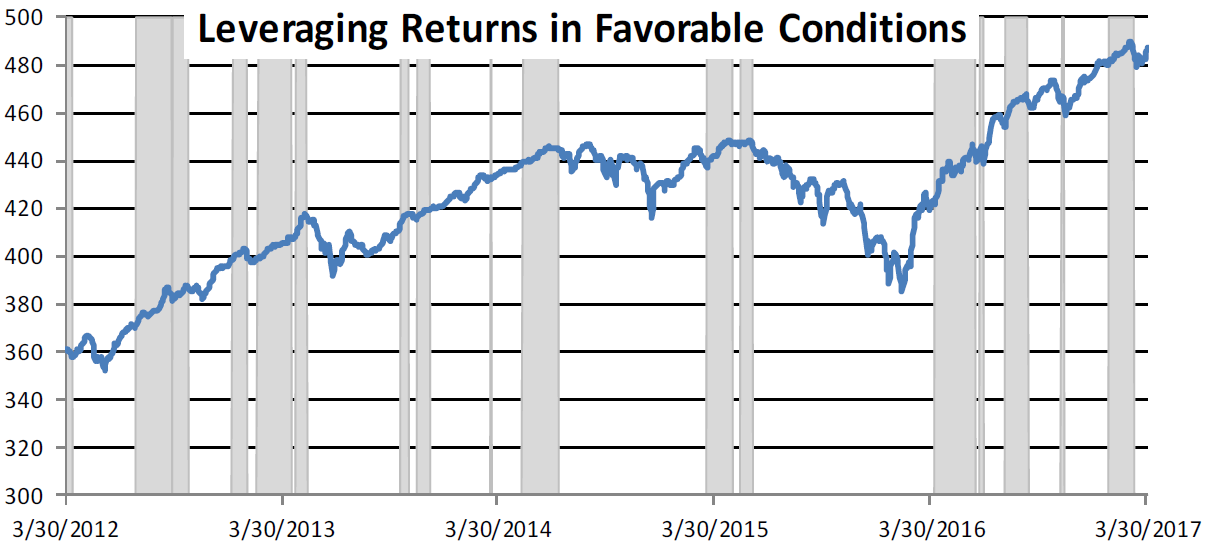

Looking at what happened in 2004, when we were midway in an economic expansion and the yield spreads were about where they are today, these charts illustrate the returns for the three years following this similar economic period. Total returns for the next few years averaged about 8.5% annually for high yield bonds. If the yield spread continues to drop, high yield bonds should continue to appreciate, but if this spread drops below 3%, a defensive strategy is likely. Currently the yield spread is 3.33%

*The CSFB High Yield Index is designed to mirror the investible universe of the $US-denominated high yield debt market.

*The CSFB High Yield Index is designed to mirror the investible universe of the $US-denominated high yield debt market.