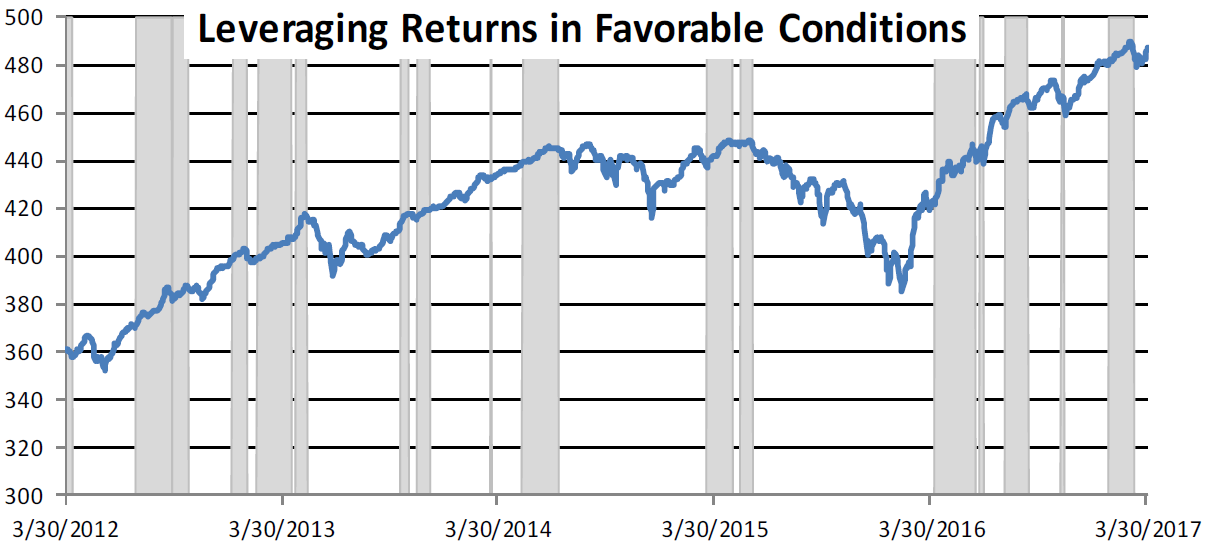

If you could purchase an apartment building today that produced a cash flow after all expenses of 8% a year, you might be pleased with your cash on cash return in the current interest rate environment. If you financed your property with a 50% mortgage which had an interest rate of 4%, you could purchase two apartments for the same equity. Scenario one has a net investment return of 8%, but the second scenario will generate a 12% net rate of return on the same investment. A downturn in real estate values might depress the investment return upon sale, but increasing values will give an even higher return. This uses the concept of leverage which can have significant advantages in certain market conditions.

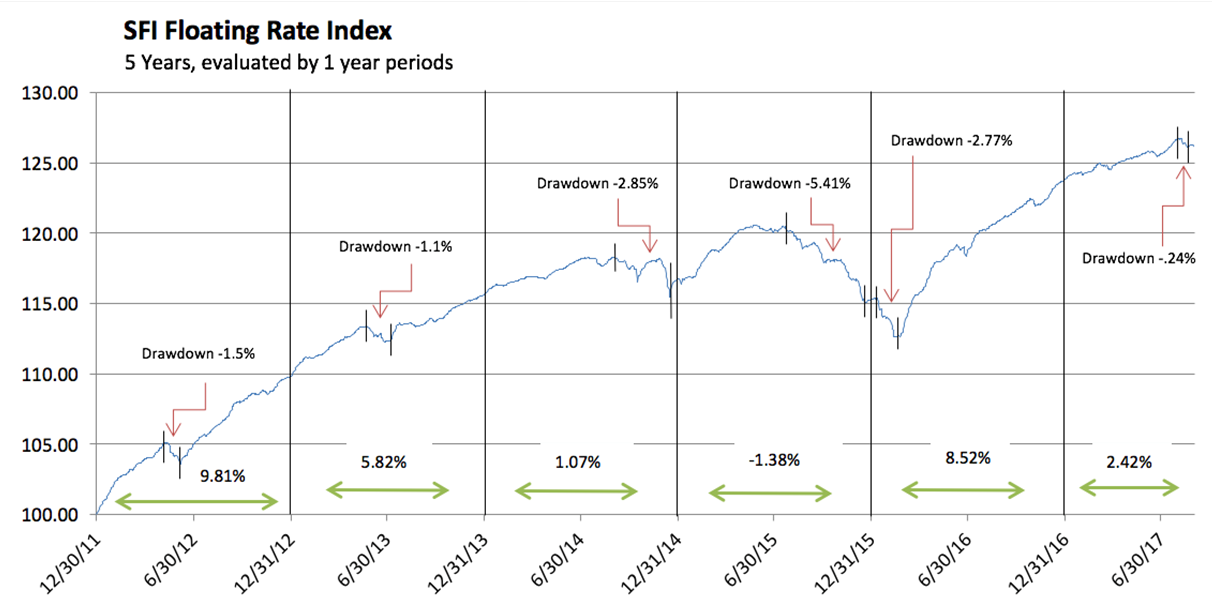

The chart below illustrates the performance of the SFI Floating Rate Index since 2012. This index is an average of four short-term senior floating rate mutual funds which accrue a daily dividend. It is normally a low risk investment that has a dividend payout currently of about 5%. Let’s say if I were able to borrow funds currently at 1.5% , and have a 50% loan amount like the previous example, I will enhance my return by 3.5% a year on the portfolio. The difference between this example and the real estate example is

with liquid investment vehicles there is daily liquidity on the investments- you must have liquidity to manage risk well.

You can go to a liquid cash position without a real estate commission or waiting around for a buyer to come along. The liquidity of the investment vehicle combined with the low volatile characteristics of this asset class can make the use of selective leverage low risk. This concept can enhance returns while still controlling investment risk when you layer a low volatile investment, like the floating rate exposure, with maybe riskier asset classes, like high yield bonds in a fund.

Selective leverage is one tool to use to meet the objectives of enhancing returns and controlling investment risk- something every investor and shareholder want. I have been applying leverage to high yield bonds and other fixed income asset classes since 1996 in SMA strategies and later in the mutual funds I manage, via derivatives and swap contracts, with the ability to still maintain low beta. Why? Because I think about risks before returns, I always use liquidity, and I know the characteristics of my underlying investments. There are times to use leverage and times when the entire portfolio should be in a liquid cash position. There must be expertise present to determine when, and where, to put leverage on or take it off. Leverage and the tools you use to present leverage in your funds or portfolios does not always mean higher risk.