Leverage is a tool that most people use on a daily basis without the knowledge they are even using it. Think of a home mortgage, this is leverage. A person is able to put down 15-20% the actual cost of the home and borrow the remainder. That person has now leveraged their money 4-5 times beyond its normal purchasing power.

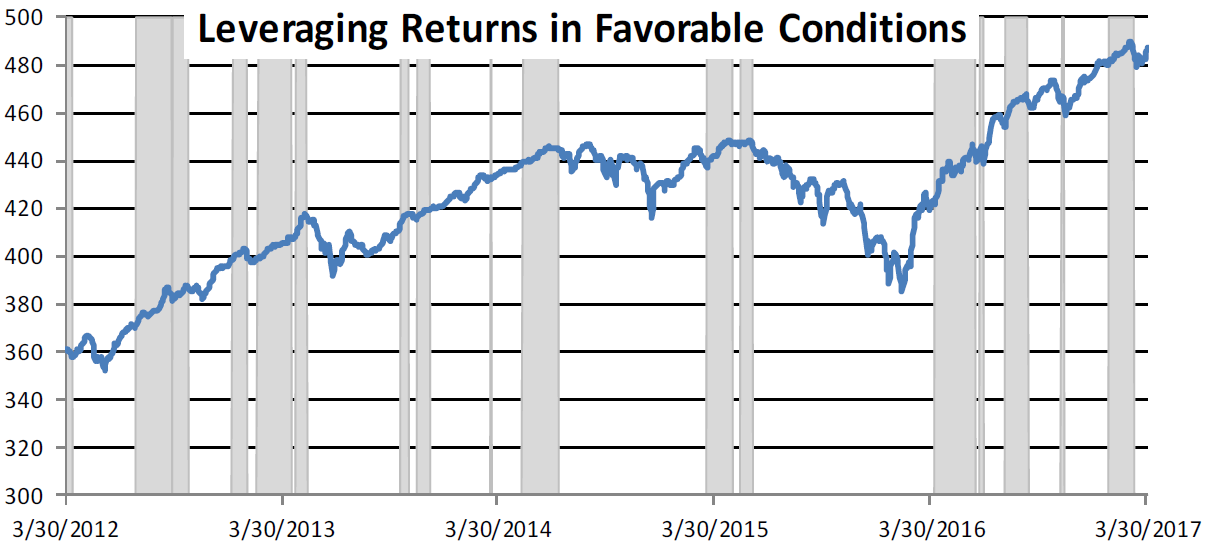

Spectrum uses leverage in some of our SMA accounts and sub-advised mutual funds to borrow money or increase exposure to potentially increase potential returns when our proprietary models indicate risk is lower and trends are established. Below is a graph showing a sampling of these periods.

Managing high yield bonds has been Spectrum’s core investment strategy since offering investment management services in 1988. We have seen about every scenario possible—war, the great recession, over- and under-valuation, and have had experience in all of them. We understand bonds, and consider them predictable, since we have observed them for over 10,000 days. If we can borrow money at 2% and purchase bonds that yield 7%, we can make a net gain of 5% in addition to the 7% bond yield. This is called “carry trade”. However, we need to have liquidity to exit these positions when they are no longer in an uptrend. Since all the funds we use have daily liquidity, we can use this strategy when appropriate without having to ride out a serious decline. So our philosophy is simply; there are times when it is good to own them, good to stand aside, and even times to consider borrowing money to own more for short periods of time when “the wind is at your back”.