The US Dollar’s impact on various asset classes had morphed over the years. One that still seems to be relevant is to foreign equities. One of the impacts is very direct and another is less direct. The first is simply by way of currency translation. A strengthening dollar, by definition, means a lower value in the local currency of which the foreign equities may be priced. A lesser impact, but one still visible, is due to how many foreign economies have a relatively high reliance on commodity-based exports. An uptrend in the US Dollar can act as a headwind to commodity prices, which in turn, can weigh on the fundamentals of foreign companies as they accept less compensation in their own currency. Even most chart-focused investors would agree fundamentals make themselves known in the longer-term trends and patterns visible on charts.

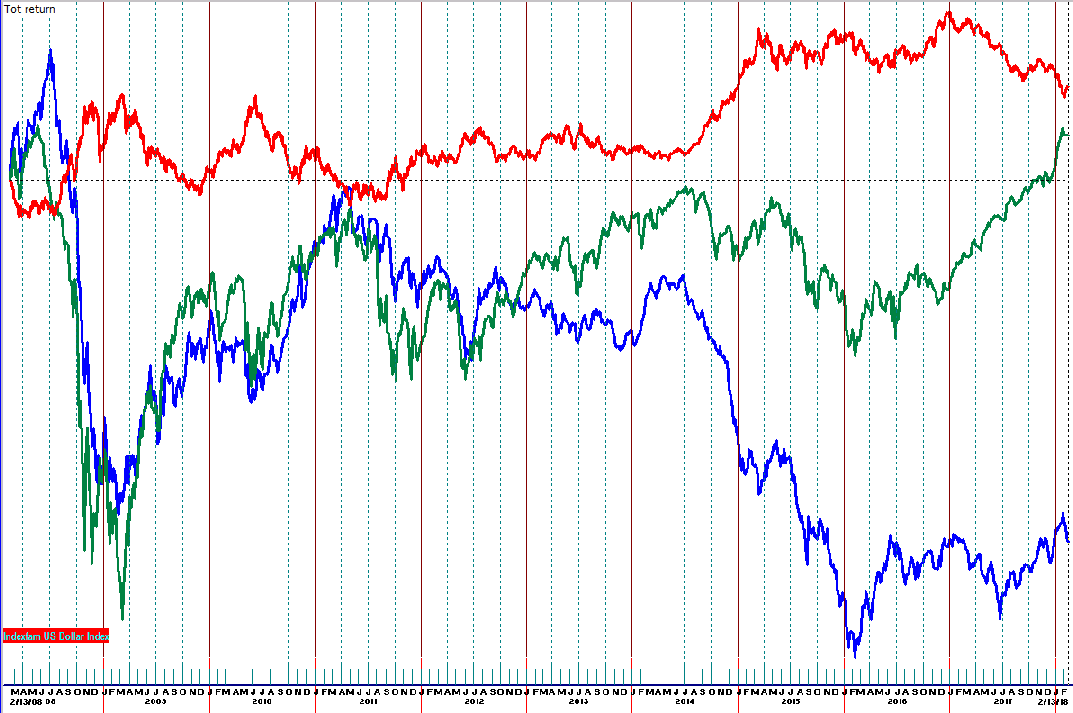

US Dollar Index = red

US Dollar Index = red

MSCI World Index (ex-US) = green

Commodity Research Bureau Total Return Index = blue

This chart reinforces the concept that the US Dollar does not act as a primary driver of macro trends but can be an influencer of how the trends take shape. “Gusting” periods, in which the US Dollar moves rapidly up or down, tend to have the most obvious impact to the global equity markets as represented by the MSCI World Index ex-US (MXWDU). Rally phases are not exclusive to falling dollar periods but that tends to be when foreign equities rise with the least amount of volatility. Rising periods by the foreign equities can be seen during rising US Dollar phases but the effort appears to be much more volatile and labored, like someone walking up a hill during a windy day. The sharpest declines in foreign equities appear to be when the US Dollar is accelerating higher. Lower volatility sideways paths in the US Dollar seem to be when foreign markets likely follow broader fundamental influences such as global economic activity.

This chart also shows how commodities, as measured by the CRB Total Return Index, has an inverse correlation to the US Dollar. This blog piece is primary to increase the awareness of the dollar’s impact on foreign equities. Many foreign, especially emerging markets, often have high levels of reliance on commodity relates industries and commodity exports. Monitoring changes in the dollar and its impact to commodities can give added color into some of what can influence foreign equities. Once again, it is important to recognize the correlation as being one over time and not highly rigid during shorter time frames.

Chart-based assessment of the US Dollar can be a useful tool to investors seeking to diversify analysis techniques. Lower relative volatility of the US Dollar may lead investors to insights more difficult to conclude if focusing methods on underlying assets with higher volatility such as commodities and foreign equities.